Wages Are Up, Mortgage Rates Are Down—What It Means for Buyers & Sellers. Toronto's top real estate agents in 2025

Thursday Apr 10th, 2025

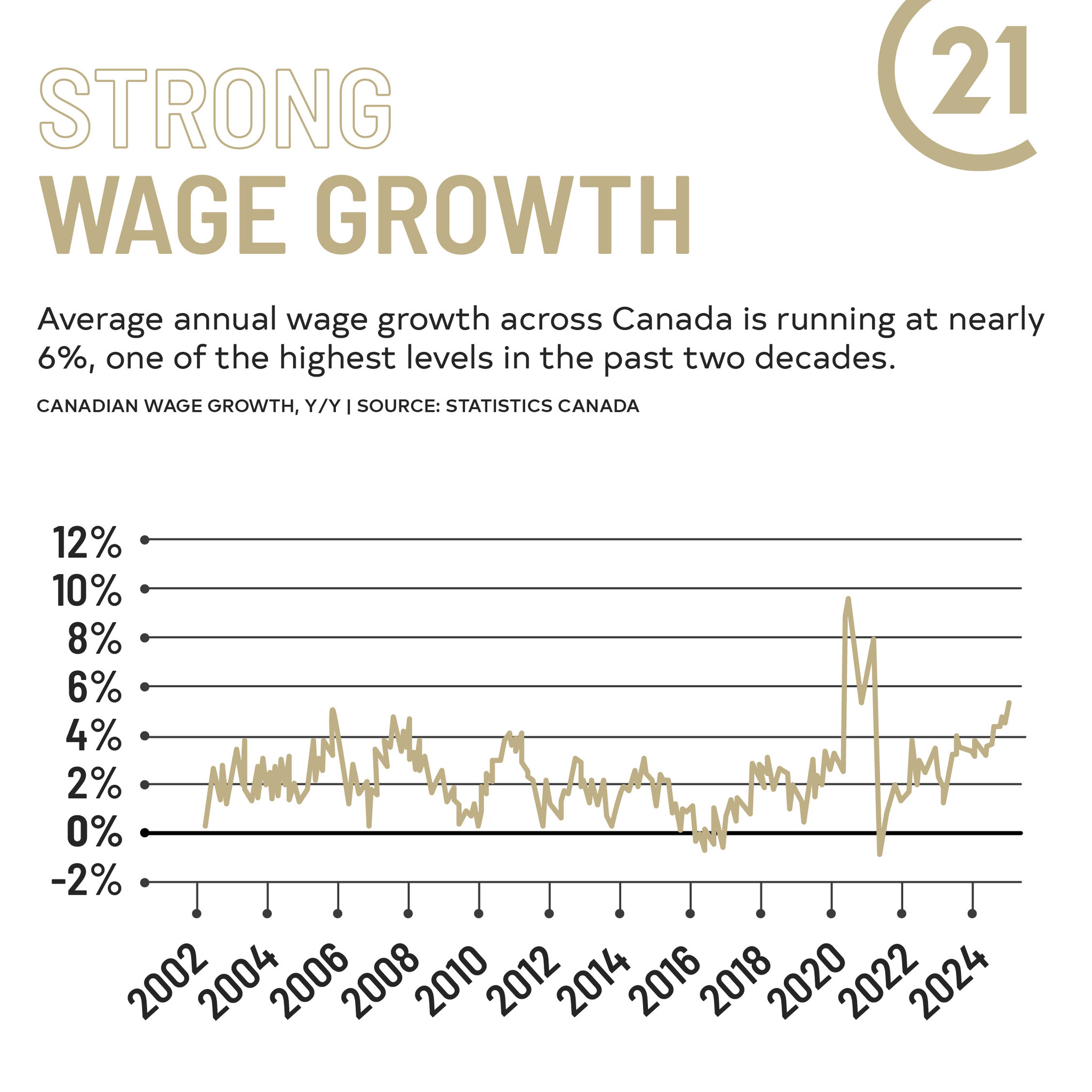

Did you know wage growth in Canada is nearing 6% annually? This is one of the strongest levels in 25 years, according to StatsCan. That’s helping improve affordability, especially with mortgage rates trending lower and home prices stabilizing. More Canadians are finally in a better position to buy.

The Bank of Canada’s affordability index showed positive movement in Q4, and while we’re not fully back to “normal,” we’re on the right path. But higher wages can also fuel inflation, which could impact future interest rate decisions. Plus, economic uncertainty—like US trade tensions—adds another layer of complexity to the market.

Below are some tailored strategies based on the current environment, along with advice for active buyers and sellers.

For Buyers:

✅ Act while rates are still low: Mortgage rates have come down, but if inflation remains a concern, the Bank of Canada could slow further rate cuts or the government may implement stricter lending policies that impact mortgage qualification. Locking in a mortgage approval at a good rate now is a smart move.

✅ Negotiate aggressively: Some sellers are still adjusting to market conditions, which can create opportunities for buyers to negotiate better deals, price reductions, or seller incentives.

✅ Focus on long-term value: Instead of timing the absolute bottom, look for properties that will hold or grow in value over the years—good locations, unique layouts, and well-managed buildings.

✅ Explore creative financing: With incomes rising, buyers may qualify for more, but structuring financing strategically (e.g. longer amortization, variable vs. fixed rates) can maximize affordability.

For Sellers:

✅ Price strategically: Buyers are gaining more leverage in negotiations, so listing at the right price from the start can attract serious interest and prevent prolonged market time.

✅ Enhance your property’s appeal: With more cautious buyers, staging, repairs, and high-quality marketing (professional photos, targeted ads) are more crucial than ever.

✅ Target motivated buyers: First-time buyers and move-up buyers with strong incomes may be in a better position to purchase now—marketing efforts should highlight affordability benefits.

✅ Stay ahead of rate shifts: If rates stabilize or even rise again due to inflation concerns, demand could soften. Selling sooner rather than later could be a strategic move.

The right strategy can make all the difference in today’s market. Contact Karen's team for a confidential discussion on how we can make your next move a success!

Post a comment