Winter Market Update! ☃️🏡 February 2024 Greater Toronto Area Real Estate News. Top customer rated real estate agents in Toronto 2024

Friday Feb 23rd, 2024

HOME SALES IN 2023:

INCREASED BUYER ACTIVITY AT THE START OF 2024:

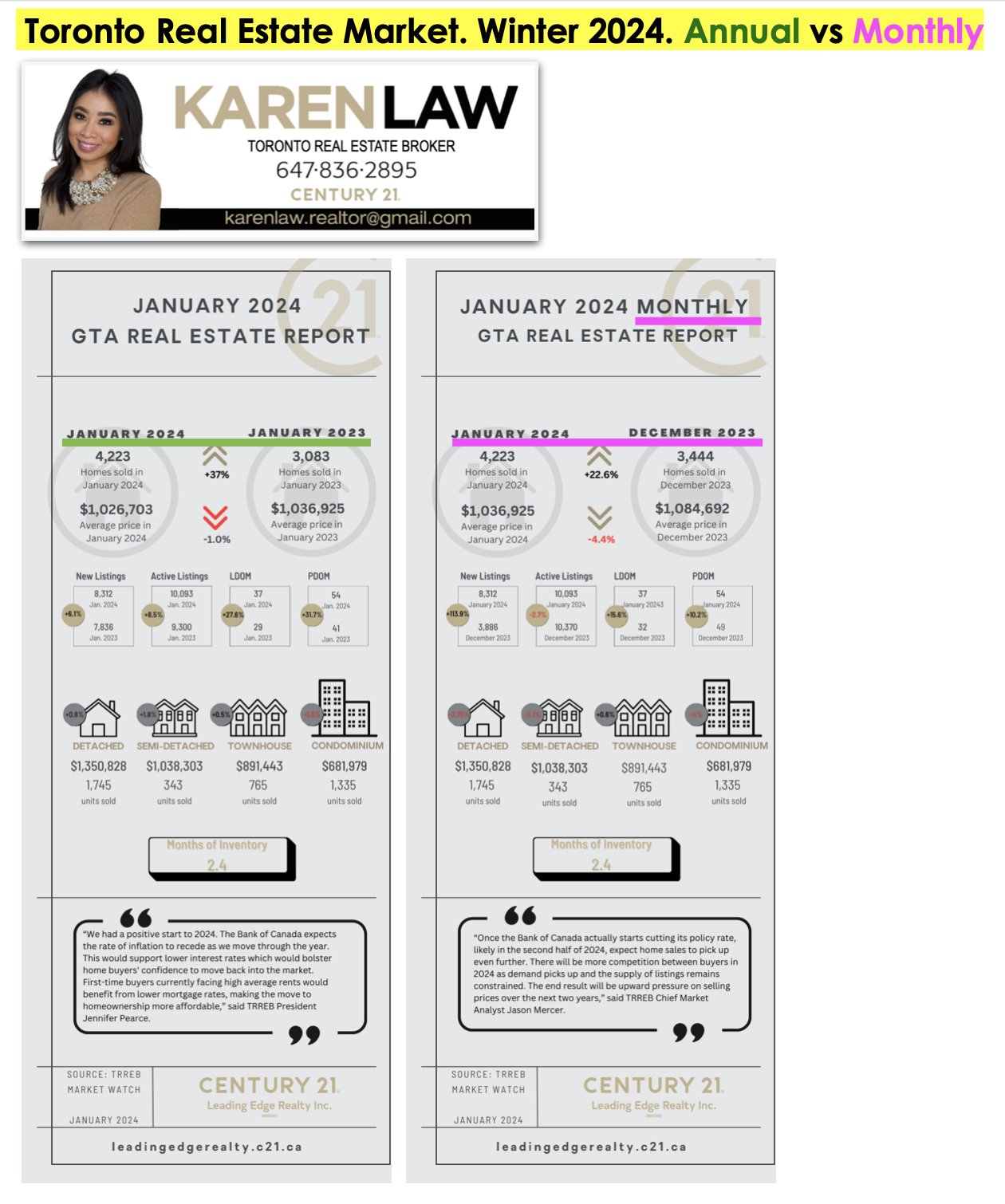

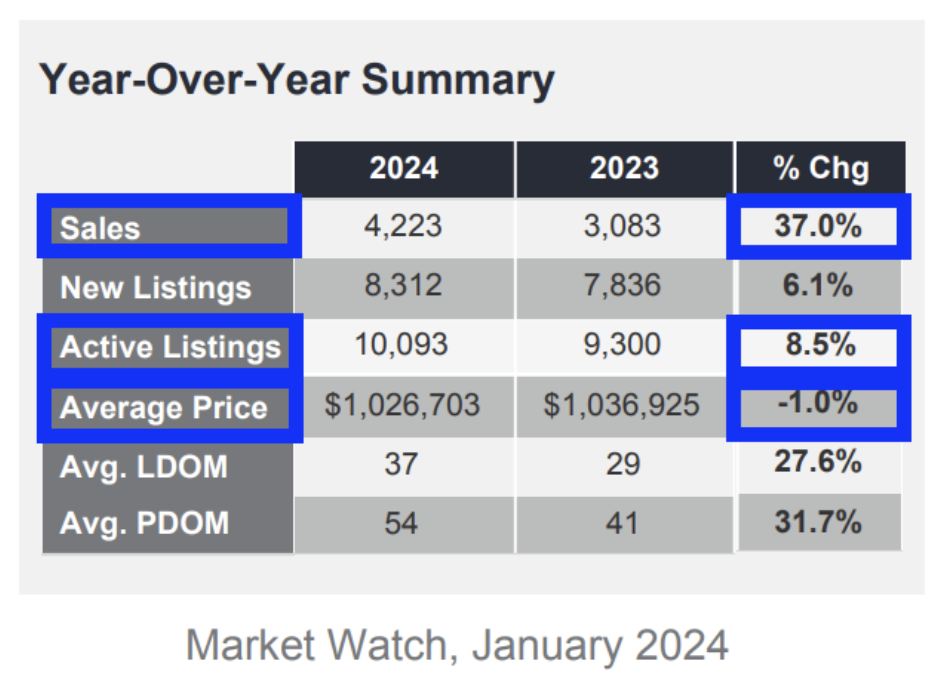

🏡 Not surprisingly, home sales in January 2024 were up +37.0% compared to the same time last year since January 2023 home sales were at a record low at only 3,100 sales. The January 2024 sales volume of 4,223 is moving towards volumes we see in a more balanced market.

📊 Why did January 2024 see increased buyer activity? Despite the Bank of Canada holding the key rate steady on January 24th, banks decreased fixed-rate mortgages following the bond yield market. Some buyers took advantage of the decreased rates since most housing prices were still soft, rather than taking a chance to wait for interest rates to further decrease when housing prices are expected to then increase.

PRICE & SALES VOLUME:

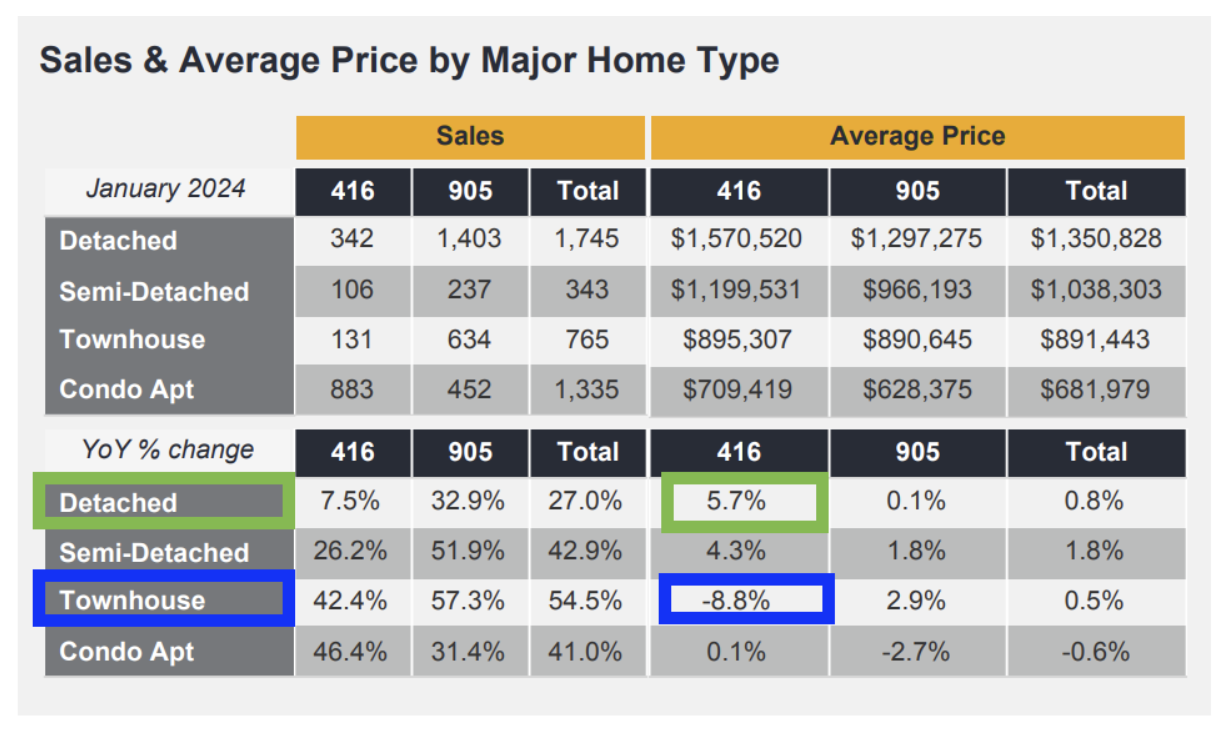

💰 ANNUAL COMPARISON: Compared to January 2023, the average property price across the board saw a slight decrease of -1.0% with the average property price at $1,026,703. However, housing types varied in performance, especially in different neighbourhoods: detached homes in Toronto saw the largest price increase on average at +5.7%, while the average Toronto townhouse experienced the most challenge with appreciation at an -8.8% price decrease over the past year.

📉 MONTHLY COMPARISON: If we look at the month-to-month comparison between January 2024 and December 2023, sales volumes increased by +22.6%. An increase in sales was expected since seasonally, December is a slow month entering into the Holidays while we see sales activity pick up in January. On the other hand, property prices on a month-to-month comparison were generally down across the board which is not typical: the average property price in the GTA was down -4.4% in January 2024. Most property types saw average prices down as well: detached homes were down -3.75%, semi's were down -2.1% and condos were down -4.0%. Only townhouses saw an average price difference in the positive between December 2023 to January 2024 with the average townhouse at a nominal increase of +0.6%, supporting a market for buyers.

📣 The number of active listings is up by +8.5% annually in the GTA, which in combination with other market factors, continues to contribute to a favourable market for buyers.

BUYERS:

For those of us in a cash position with a long-term investment strategy in mind, our GTA market continues to offer incredible opportunities to purchase real estate right now. This is the market to purchase real estate in if you are financially able to do so. Prices have softened substantially with our team securing properties for buyer clients at record-breaking prices seen in 2020-2021. Active buyers, particularly in the condo market, are benefitting from a substantial amount of inventory to choose from and with significantly fewer qualified buyers who can purchase. This is the market buyers have been dreaming of for years when the GTA was experiencing many multiple offers in a seller's market. Today, in many markets throughout the GTA, buyers have a rare upper hand in securing a great deal on a property and are often able to obtain their ideal closing date - in some circumstances, buyers are also in a position to include additional contingencies in an offer for extra due diligence such as a home inspection. For those who are financially qualified to purchase, nobody is sure how long this buyer's market will sustain: there is a risk of losing out on this opportunity for those who prefer to "time the market". Many indicators are pointing toward a more balanced market in Spring/Summer 2024 when the majority of industry experts are anticipating the Bank of Canada will begin decreasing their key rate. And a more balanced market will not be as favourable to buyers as our current market is.

SELLERS:

For most markets and some property types, it remains best to hold off listing a property for sale until the market shifts towards a more balanced market. Assuming the Bank of Canada begins decreasing rates this year, the industry is expecting tighter market conditions to follow which would lead to consistent renewed price growth once again. That would be a precursor for a more favourable time to market your property for sale.

While the latest Toronto Regional Real Estate Board (TRREB) stats indicate an +37.0% increase in sales volumes compared to a year ago in January 2023, please keep in mind our January 2023 sales volumes were a bit low. If we look at a stronger seller's market back in January 2022 with 5,636 sales, our current market is operating at a -25.07% lower sales volume. Combining this with +8.5% more active listings than a year ago and most average home prices still in a slight negative on an annual comparison, it is in our best interest to hold off listing a property for sale until the Bank of Canada begins cutting rates and we see a shift towards a more balanced market.

Now for those who are not in a position to hold off selling a property, you will want to ensure you partner with a trusted real estate team who will offer a strong marketing plan with ongoing marketing initiatives beyond the standard MLS system. Give our team a call by clicking the link below for a confidential discussion about your real estate needs.

WHAT TO EXPECT IN 2024:

🔮 The industry is expecting the Bank of Canada to cut rates during the first half of 2024: there are eight Bank of Canada rate announcement dates in 2024 to keep a watchful eye on with the next announcement date less than a couple of weeks away on Wednesday, March 6th. As we begin to see rate cuts, the overall consensus is that the real estate market will begin to shift towards a more balanced market with higher sales volumes and increased housing prices.

There are many fantastic opportunities for buyers: the current market is at a very relaxed pace to shop where there is significantly more inventory to choose from and in many markets throughout the GTA, you can likely avoid the stress of a bidding war. For those who are looking to sell a property, you can make a significant impact by working with the right team to assist with preparation, effective marketing and implementing the right pricing strategy.

If you're looking for guidance to navigate this market & effectively achieve your goals of selling or purchasing real estate, contact our team at 647-836-2895

Post a comment