Toronto Real Estate Update December 2022. Top 10 real estate agents in Toronto

Sunday Dec 11th, 2022

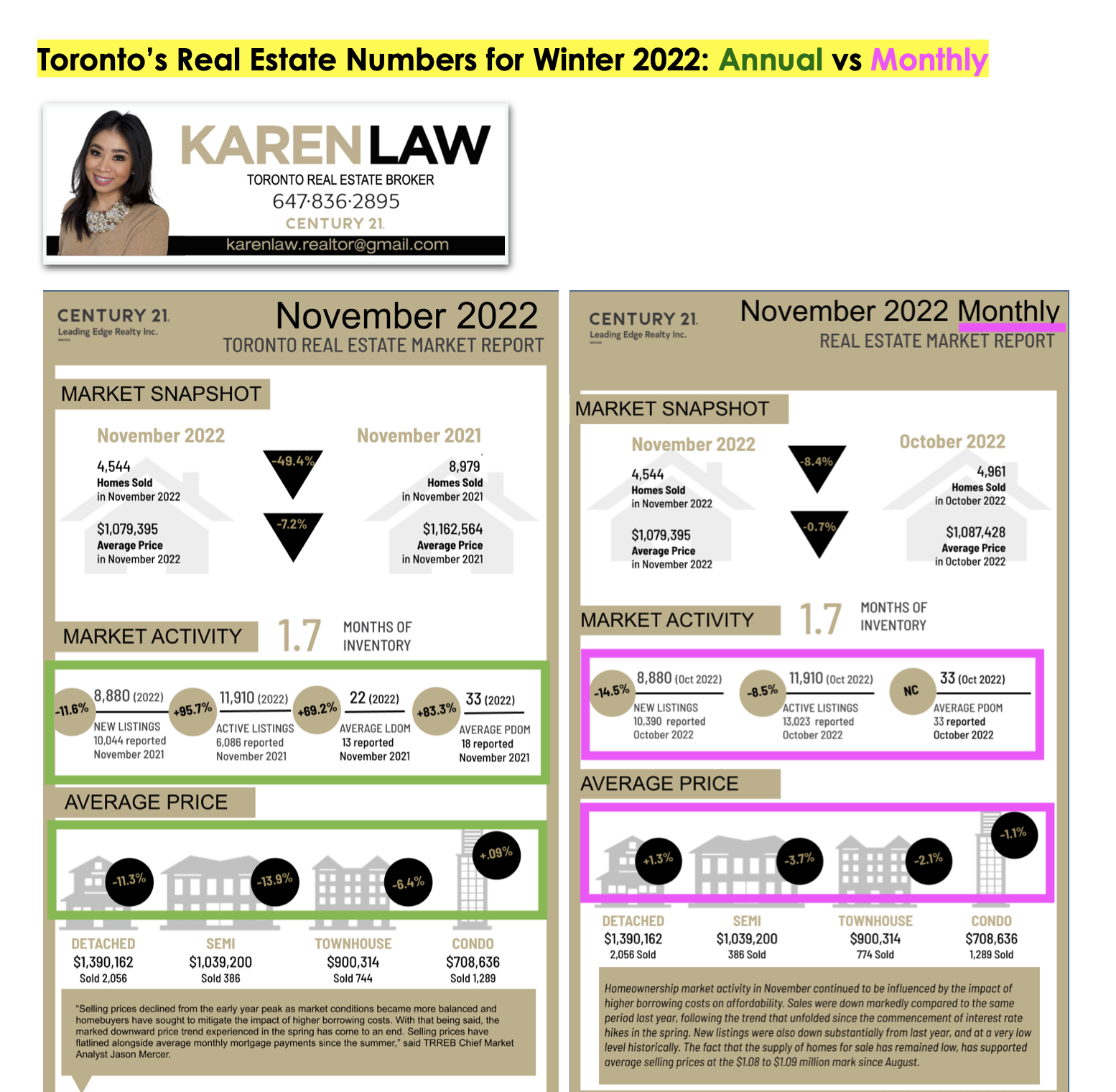

Our latest GTA (Greater Toronto Area) market report for this winter continues to reflect how increased mortgage interest rates are heavily reducing the number of individuals purchasing and selling real estate, along with reducing housing prices ![📉]()

![🏡]()

This past week on December 7th, our Canadian government increased the mortgage interest rates by an additional 50 basis points to help curb inflation. The prime rate is now 6.45%. In comparison to last November 2021, the prime rate was significantly lower at 2.45%.

As a result of the higher costs of home ownership, the volume of sales has dropped nearly in half compared to last winter: sales volumes are down ![⬇️]() -49.4% compared to the same time last year.

-49.4% compared to the same time last year.

-49.4% compared to the same time last year.

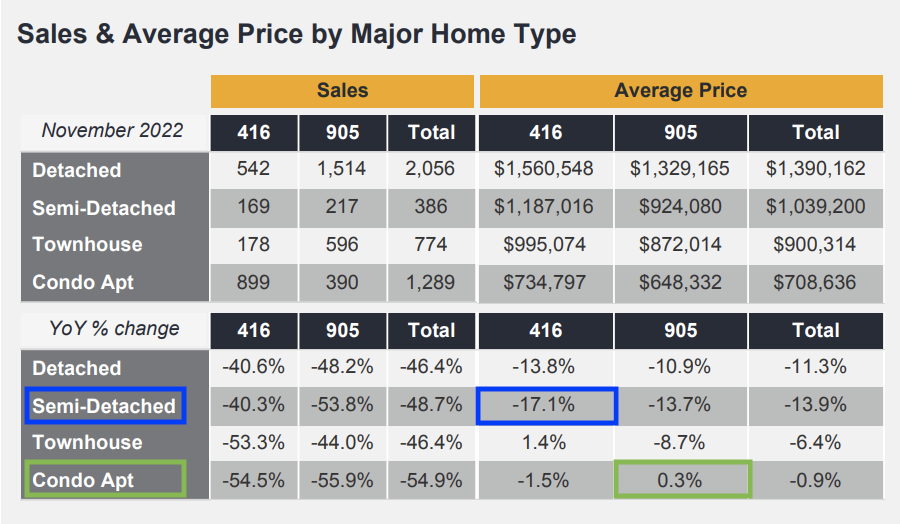

-49.4% compared to the same time last year. With the reduced demand to purchase properties, housing prices continue to remain . The more expensive housing sectors, detached homes and semi-detached homes in Toronto, saw the strongest price decreases over the past year. Semi-detached homes in Toronto experienced the biggest price drop of -17.1% between November 2021 to November 2022.

On the other hand, the market sector that saw the highest annual price increase on average was Toronto townhouses which saw a conservative +1.4% increase in prices between November 2021 to November 2022.

The downward price trend seen in the Spring is slowing down with housing prices beginning to flatline throughout the Fall. Industry experts are predicting that housing demand will pick back up in the GTA over the medium to long-term outlook as a result of record-high immigration. For those in a cash position who are able to purchase real estate in the GTA and able to hold onto properties over the mid-to-long term, our current buyer's market is a good time to act.

Post a comment