Toronto real estate market update July 2022 🏡 Greater Toronto Area real estate market summer 2022

Saturday Jul 09th, 2022

How is the GTA real estate market doing? 🏡🤔

Our GTA housing market is experiencing a slowdown as a result of government initiatives.

Why? The slowdown is mainly driven by increasing mortgage interest rates, which are implemented to help offset our country's 40-year record high inflation. With strong speculation that the Bank of Canada will increase rates by an additional 75 basis points on July 13th and another 50 basis points in September, this will be our largest annual rate increase since August 1998, meaning we will likely experience a continued market slow down for the time being.

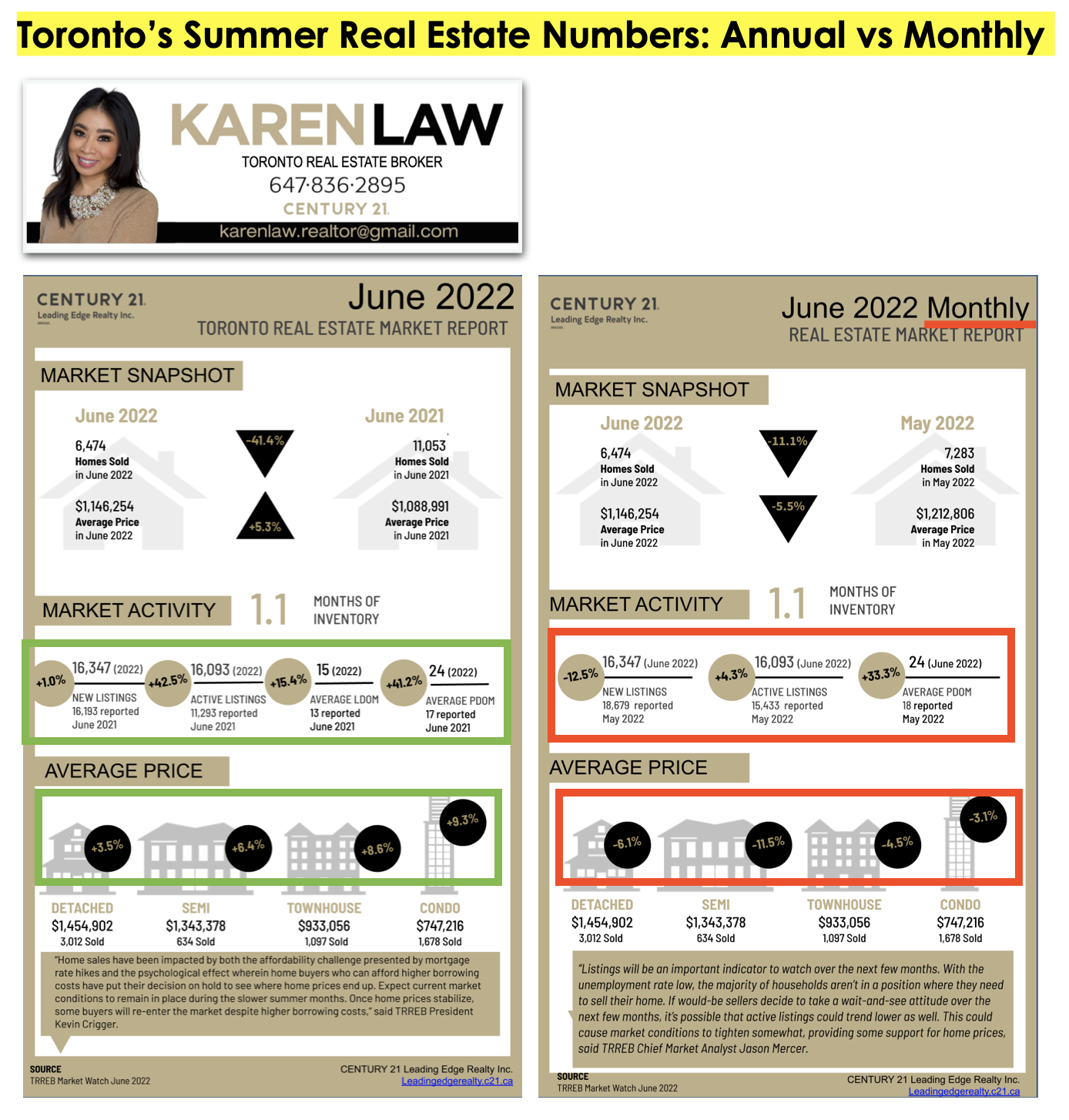

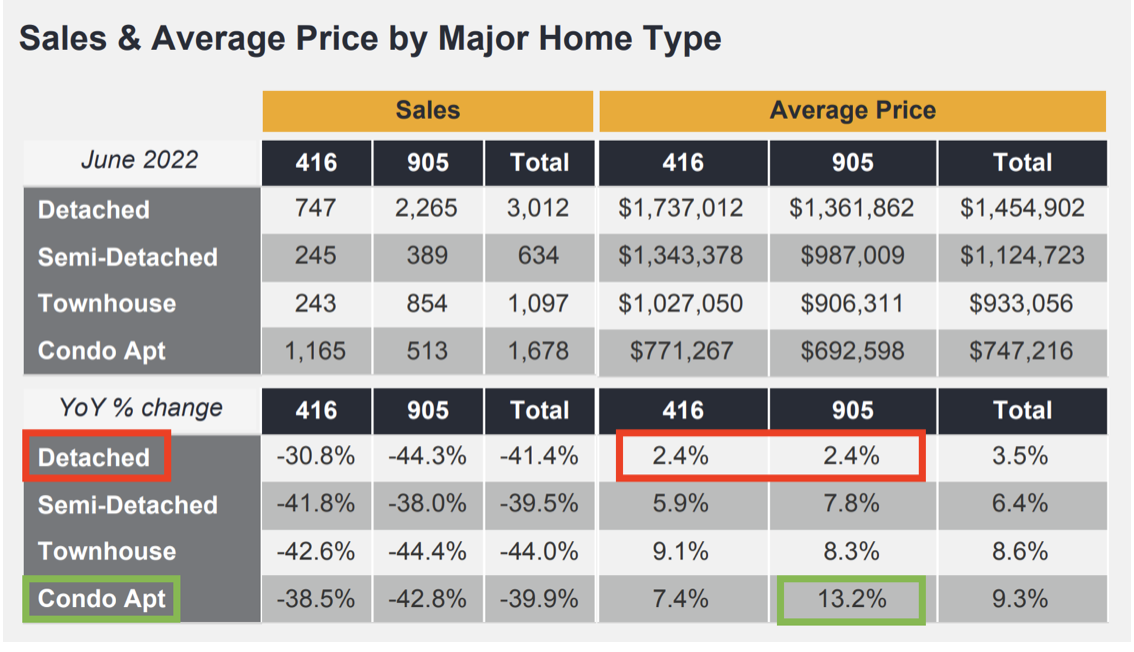

On an annual comparison between June 2021 to June 2022, all housing sectors in Toronto and the suburbs saw increases in home prices.

The housing sector that saw the highest increase in value, on average, is the most affordable housing sector which is the suburban condos. Suburban condos saw a solid +13.2% increase in prices between June 2021 to June 2022.

On the other hand, the housing sector that saw the lowest increase in value, on average, were fully detached homes in Toronto and the suburbs which both saw a conservative +2.4% increase in prices between June 2021 to June 2022.

On a month-to-month comparison, between May 2022 to June 2022, all housing sectors dropped in price values from as low as -3.1% for condos to as high as -11.5% for semi-detached homes.

Tips for Selling

*consider keeping your property as an investment and renting it out. With the majority of rental properties seeing significant increases of around +17% compared to last summer, this is an opportunistic time for owners to allow the rent to cover the cost of ownership for at least another year or two until our inflation is under control and the overall economy has improved. Once our 40-year record high inflation has normalized and the economy has improved, our real estate market is very likely to shift back in favour of sellers

*if you have decided to sell a property this year and keeping it as an investment property is not an option, it is in your best interest to market your property for sale sooner than later. With our government planning multiple interest rate hikes for the remaining half of this year to help offset inflation, the current slow down in buyer activity we have seen since early March is an indication that future rate hikes this year will further impact the market in favour of buyers. Back in April, our team predicted that our typical 25%-30% annual appreciation for freehold would drop down to 15% or less by this summer with two more rate hikes: sure enough, this prediction came true as freehold is already down to 2.4-9.8% annual appreciation.

Consider working with a team that provides an effective marketing plan to maximize your property's exposure in order to achieve the highest possible sold price in this shifting market.

Tips for Buying

*if you're actively looking to purchase in the GTA, you will have noticed much more inventory on the market over the course of these past few months (+42.5% more listings than last summer!). While a minority of purchasers have decided to temporarily pause their home search in hopes that housing prices drop further, I strongly encourage purchasers to consult with their mortgage broker and understand the full impact of increased carrying costs due to a significantly higher mortgage interest rate later this fall or winter. Purchasers will want to understand what is realistic in terms of estimated increased carrying costs by waiting until later this year to purchase versus the upfront savings from estimated real estate price drops by waiting to purchase later this year. Also keep in mind that although most purchasers secure the right home within 2-3 months of a search, some purchasers might take one year to find the right property. Based on your personal experience, if your home searches have taken longer than 4-6 months, consider what will happen if you wait to purchase a home in an attempt to time the market, and what would also happen if the right property was not found within that window of time when the market is in a buyer's favour. Is there a likelihood the market would recover back to a seller's market by the time the right property is found for you? As long as your intent to purchase is to hold onto a property for at least three years, I encourage purchasers to move forward when the right property presents itself, in order to not miss the right opportunity by attempting to "time the market"

*depending on your personal finances and the type of property you are looking to purchase, you may want to adjust the timing on a purchase to consider how/if multiple rate hikes this year will impact your affordability and the possible impacts on the market. If multiple rate hikes will impact your affordability negatively, consider moving up your timeline to purchase, ideally before the next two likely rate hikes on July 13th and September 7th.

Consider working with a team that can guide you in your home buying journey and a team who can provide access to off-market exclusive listings including VIP broker pre-construction pricing, to provide you with more options!

Post a comment