Toronto Real Estate Market Report December 2023. Toronto real estate agents with the most record home sales

Tuesday Dec 19th, 2023

Winter Market Stats ☃️🏡

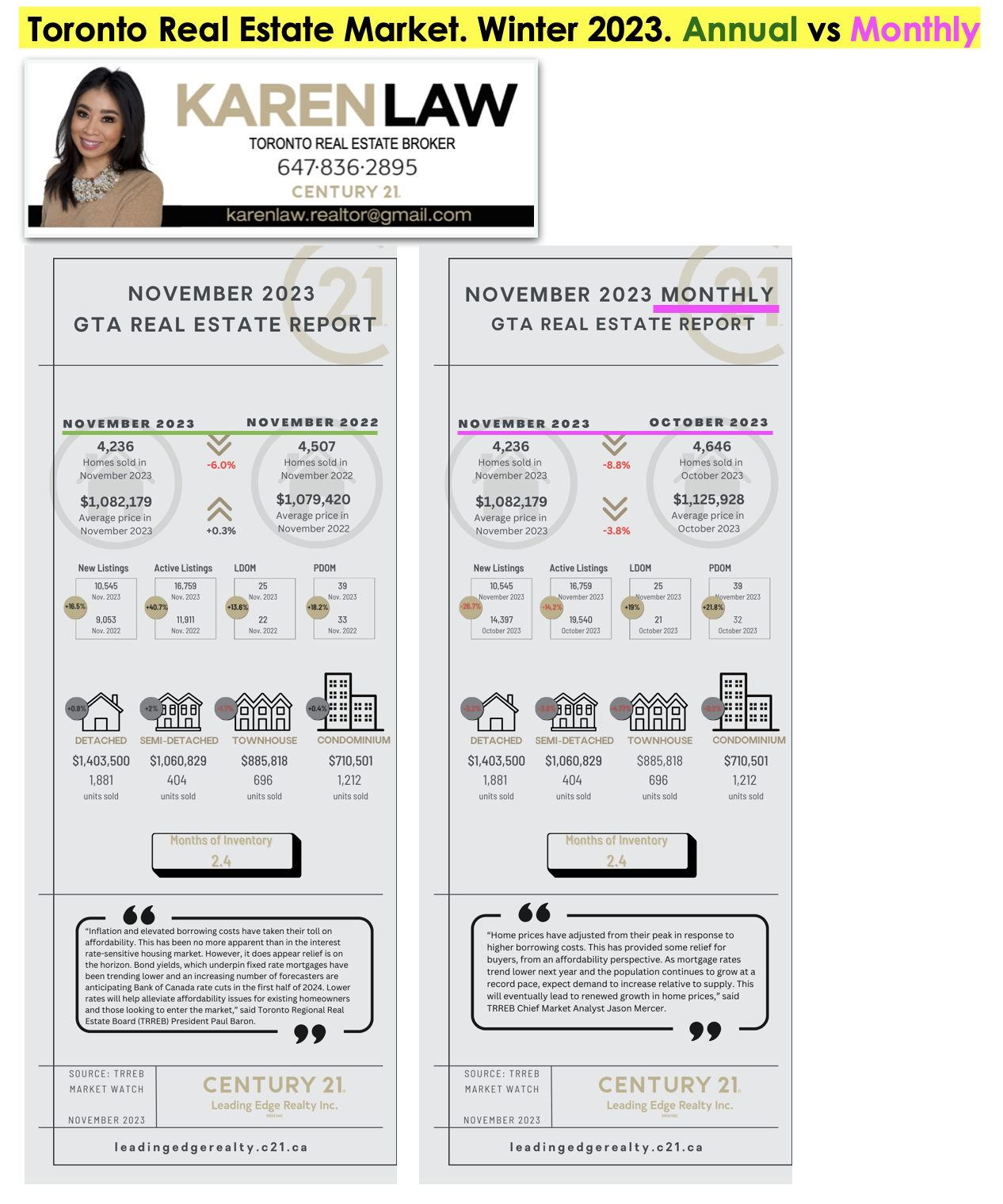

PRICE & SALES VOLUME:

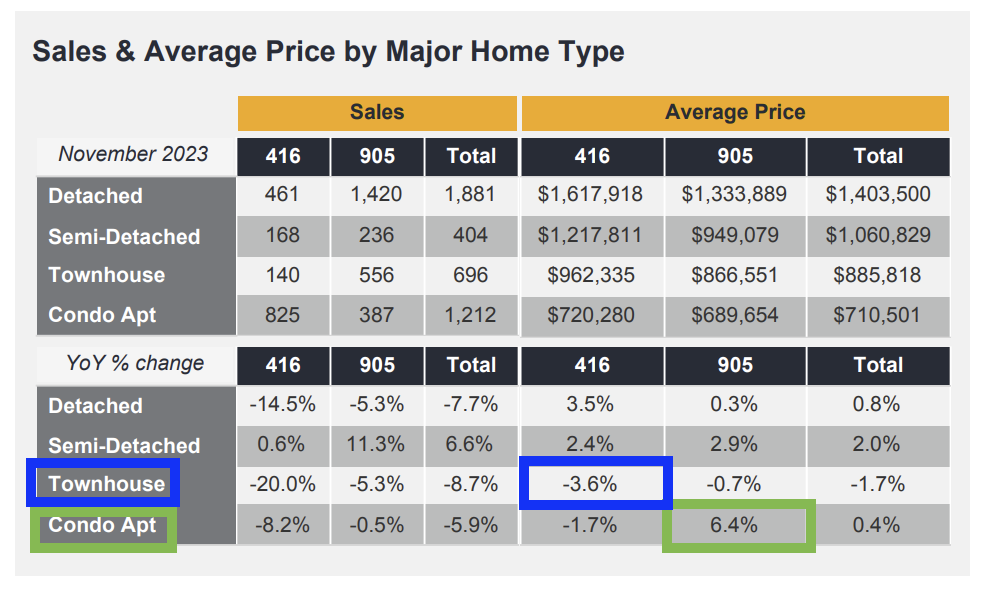

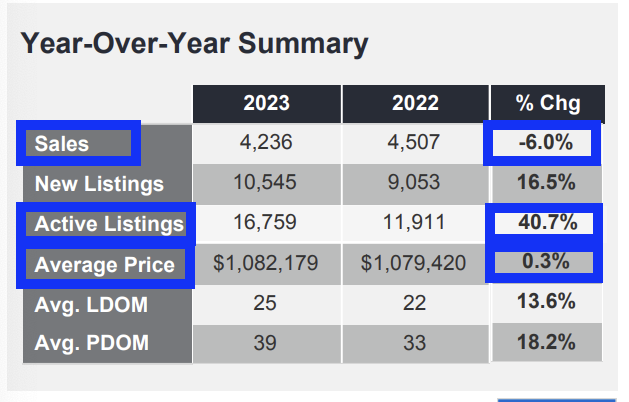

💰 Compared to last year November 2022, the average property price remains nearly the same at a +0.3% increase. When comparing all housing types, townhouses in Toronto saw the largest annual price drop at -3.6%, while suburban condos held on the best with a +6.4% price increase over the past year.

If we look at the month-to-month comparison between October 2023 and November 2023, we see that all housing prices have decreased by an average of -3.8% and sales volumes are down a further -8.8%. We're looking at softer prices and sales numbers as we move further into this last quarter. Townhouse prices decreased the most at a -4.77% price decrease between October to November, while condo prices held on the best at a -0.20% price decrease.

📈 The number of active listings is up by a significant +40.7% in the GTA, creating a very relaxed market for buyers. That said, with interest rates at a 22-year high in Canada, high borrowing costs and uncertainty around economic conditions have driven sales numbers down by an additional -6.0% compared to last year November 2022.

BUYERS:

For those of us in a cash position with a long-term investment strategy in mind, our GTA market continues to offer incredible opportunities to purchase real estate right now. This is the market to purchase real estate in if you are financially able to do so. Prices have softened substantially with our team securing properties for buyer clients at record-breaking prices seen in 2019-2020. There is a lot of inventory to choose from and with significantly fewer qualified buyers able to purchase, this is the type of market buyers have been dreaming of for years when the GTA was experiencing many multiple offers in a seller's market. Today, buyers also have a rare upper hand in requesting their ideal closing date and sometimes being able to include contingencies in an offer, such as a home inspection. For those who are financially qualified to purchase, nobody is sure how long this buyer's market will sustain: there is a risk of losing out on this opportunity for those who prefer to "time the market". Many indicators are pointing toward a more balanced market in Spring/Summer 2024 when the majority of industry experts are anticipating the Bank of Canada will have begun decreasing rates. And a more balanced market will not be as favourable to buyers as our current market is.

SELLERS:

Ideally it is best to hold off listing a property for sale until the market shifts towards a more balanced market.

While the latest Toronto Regional Real Estate Board (TRREB) stats indicate only a -6.0% decrease in sales volumes compared to last year November 2022, please keep in mind November 2022 sales volumes were low. If we look at November 2021 sales volumes at 9,017 sales compared to last month's 4,236 sales, it's a staggering -53.02% lower sales volume. In all fairness, November 2021 was a hot seller's market: thus, if we compare our latest November 2023 sales volumes to a "balanced market", we are looking at about 35%-40% fewer sales. Combining this with +40.7% more active listings than last year November 2022, it is certainly in our best interest to hold off listing a property for sale until the Bank of Canada has begun cutting rates and we see a shift towards a more balanced market. On a positive note, bond yields which underpin fixed-rate mortgages, have been trending lower: this is a strong indicator that we will see rates cut during the first half of 2024.

Now for those who are not in a position to hold off selling a property, you will want to ensure you partner with a trusted real estate team who will offer a strong marketing plan with ongoing marketing initiatives beyond the standard MLS system. Give our team a call by clicking the link below for a confidential discussion about your real estate needs.

WHAT TO EXPECT AS WE ENTER THE NEW YEAR:

The industry is expecting the Bank of Canada to cut rates during the first half of 2024: there are eight Bank of Canada rate announcement dates in 2024 to keep a watchful eye on with the next announcement date set for Wednesday, January 24th. As we begin to see rate cuts, the overall consensus is that the real estate market will begin to shift towards a more balanced market.

There are many fantastic opportunities for buyers: the current market is at a very relaxed pace to shop where there is significantly more inventory to choose from and you can likely avoid the stress of a bidding war. For those who are looking to sell a property, you can make a significant impact by working with the right team to assist with preparation, effective marketing and the right pricing strategy.

If you're looking for guidance to navigate this market & effectively achieve your goals of selling or purchasing real estate, contact our team at 647-836-2895 ☎️

Post a comment