Toronto Real Estate Market March 2023. Toronto's Top 10 Real Estate Agents. Highest customer rated real estate agents in Toronto

Friday Apr 07th, 2023

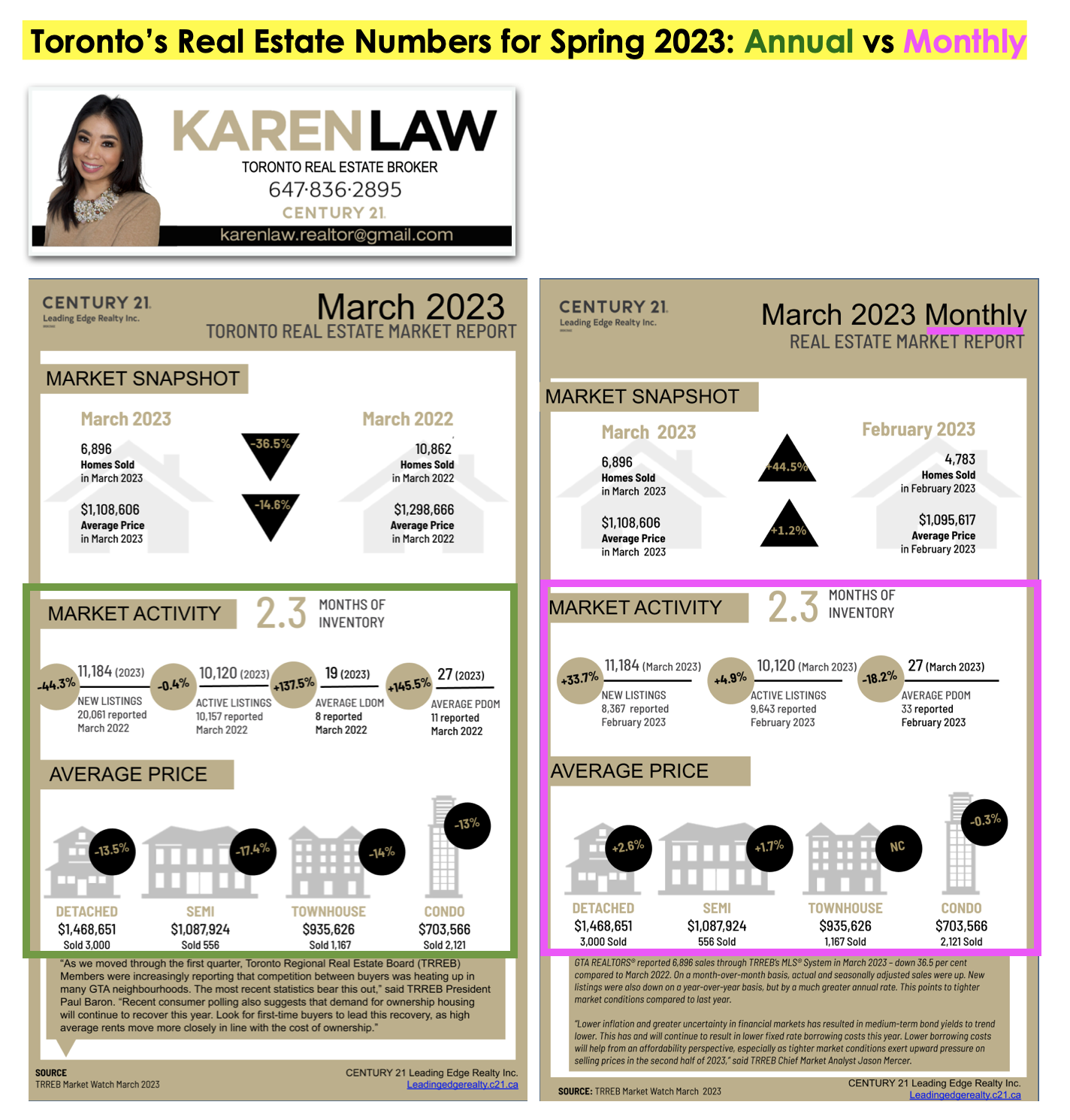

Are we seeing a seasonal increase in the market?

Yes, we're beginning to see the Toronto real estate market pick back up in terms of sales volume and price, particularly for entry-level priced properties 🏡📈

💰 March was the second month in a row this year to see home price increases: while the +1.2% home price increase between February 2023 and March 2023 seems minimal, it is showing signs of a Spring market shifting more in favour of selling.

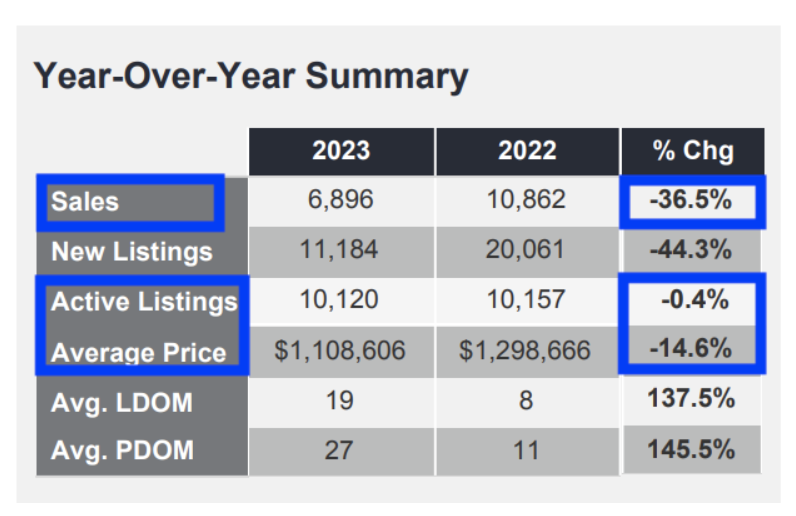

📈 As the Greater Toronto Area (GTA) headed into Spring, sales volumes increased by a significant +44.5% between February to March. This means that buyers who have been waiting on the sidelines for entry-level priced properties, are best to act swiftly before market conditions tighten and become more competitive with multiple offers.

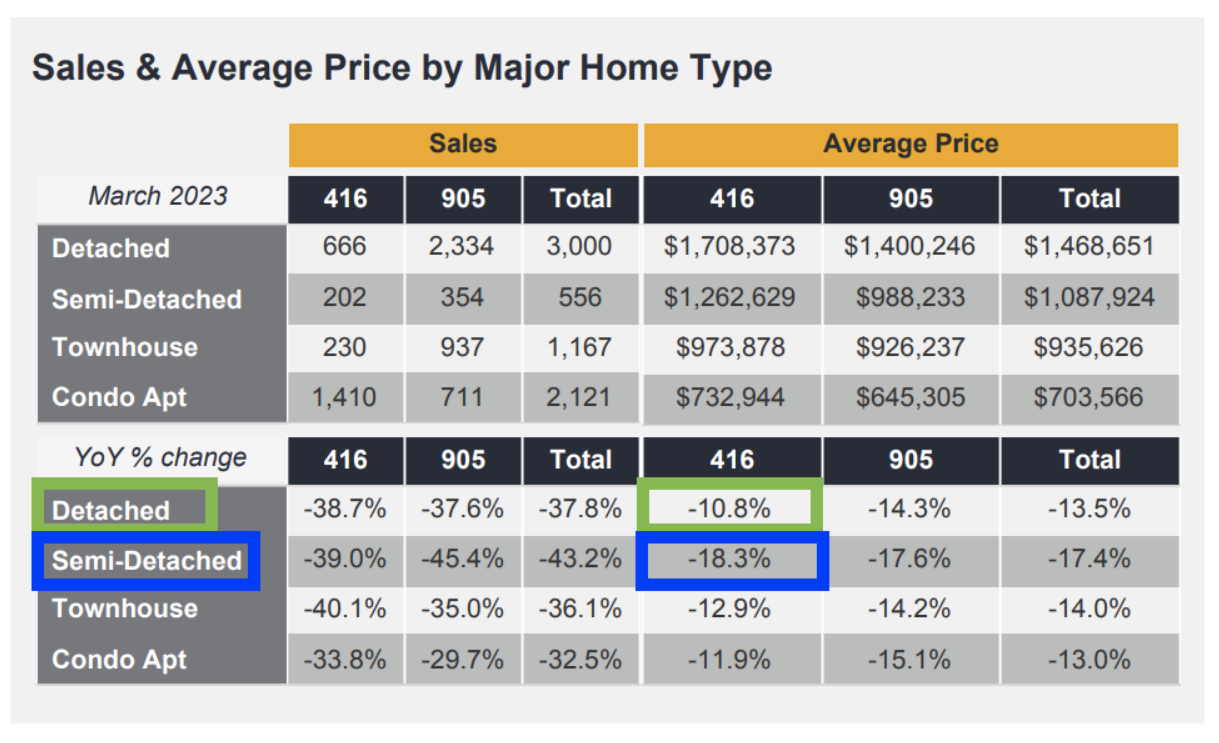

Buyers purchasing semi-detached homes in Toronto are favoured with the largest price decrease in Toronto semi-detached homes. Over the past year, Toronto semi-detached homes saw the largest average price drop of -18.3% between March 2022 to March 2023. On the other hand, Toronto detached homes held on the strongest with their property values, decreasing in price by an average of -10.8% over the past year.

Mortgage Rates & Home Ownership Costs

The Toronto Regional Real Estate Board's Chief Market Analyst mentioned medium-term bond yields have been trending lower as a result of lower inflation and greater uncertainty in the financial markets. This will likely lead to lower fixed mortgage rates this year, which is good news for buyers as it helps lower borrowing costs for homeownership. Lower fixed rates will also provide some relief for homeowners who are refinancing or renewing a mortgage this year.

The Bank of Canada is set for another prime rate announcement this coming Wednesday, April 12th. Let's see the Bank of Canada's decision on our prime rate, based on their assessment of the economy.

Tips for Selling

*continuing with the trend we saw in February, entry-level priced properties throughout the GTA that are priced below $1M continue to receive the strongest demand. And those entry-level priced properties that are showing well are experiencing many multiple offers. If you are looking to successfully sell an entry-level priced property, consider holding off offers for 5-7 days to help drive in multiple offers. It is also to your benefit to work with a real estate team that offers a pre-marketing period where the property is extensively marketed before the official launch date in order to attract more potential buyers during those 5-7 days on the market: contact Karen's team by clicking here, to learn about our successful pre-marketing strategies.

*keep in mind that the increased demand with multiple offers is only seen in certain markets. When it comes to mid-range properties and especially higher-end luxury properties, these markets are still generally experiencing a considerable length of time on the market with some properties unable to sell. In comparison to early last year, home ownership costs are still significantly higher due to the current mortgage rates. Also, the current foreign buyer's ban has also negatively impacted our higher-end markets. While sales volumes have increased on a monthly basis, to put things into perspective, sales volumes are still down -36.5% compared to March 2022. While our current market is much more favourable for entry-level priced homes, if you are selling a mid-range or luxury property, assess the feedback from buyer showings within the first 1-2 months on the market. If your property is receiving less than 10 showings a month with no offers, be open to changing your strategy in order to get the property sold. This might require (i) adjusting the price to market demands or (ii) making certain upgrades/repairs in order for prospective buyers to come forward with an offer close to your list price or (iii) taking the property off the market and re-listing it for sale when the market recovers while renting it out in the interim to help cover the costs of ownership.

*if you decided to sell a property this year, consider moving up your timeframe to market your property for sale this Spring before more inventory comes on the market. Traditionally, as we head into the Spring and Summer, we see more inventory meaning more competition among sellers: this is not favourable on the selling side. Also, we may see an increase in inventory in a non-traditional way as some homeowners might be forced to sell if homeownership costs become too high as their fixed-rate mortgages come up for renewal this year. These are some factors to consider with timing your move: work with a good real estate team to assess your local market and inventory trends to help with your decision-making.

Tips for Buying

*for buyers who are looking for entry-level priced properties, now is the time to move. Well in hindsight, it would have been more favourable to be under contract in early 2023, however, if that did not happen the second best time is now. The past few weeks have seen more multiple offers for entry-level priced properties, which can be challenging and exhausting on the purchasing side. With additional mortgage rate hikes not likely occurring after this summer, this means the chances of the market softening again in favour of purchasing are very slim. Also, with higher rental prices as we enter the Spring and Summer months, we are anticipating more first-time home buyers aiding the market recovery as rent prices approach home ownership costs. These are some external factors that are tightening the market for buyers at entry-level priced properties. For purchasers falling in this category, it's prudent to act swiftly this Spring as the window of opportunity for deals at the entry-level range is narrowing quickly.

If you're looking for guidance to navigate this market & effectively achieve your goals in selling or purchasing real estate, contact our team at 647-836-2895 ☎️

Post a comment