Toronto Real Estate June Market Update - Buyers Still Remain on Sidelines Amid Market Opportunities 🏡 Best Toronto Real Estate Agents. Top Rated Reviews

Monday Jul 08th, 2024

Buyers Still Remain on Sidelines Amid Market Opportunities 🏡

📉 HOME PRICES

✨ Average home prices in the Greater Toronto Area (GTA) are down both on an annual comparison and also on a monthly comparison

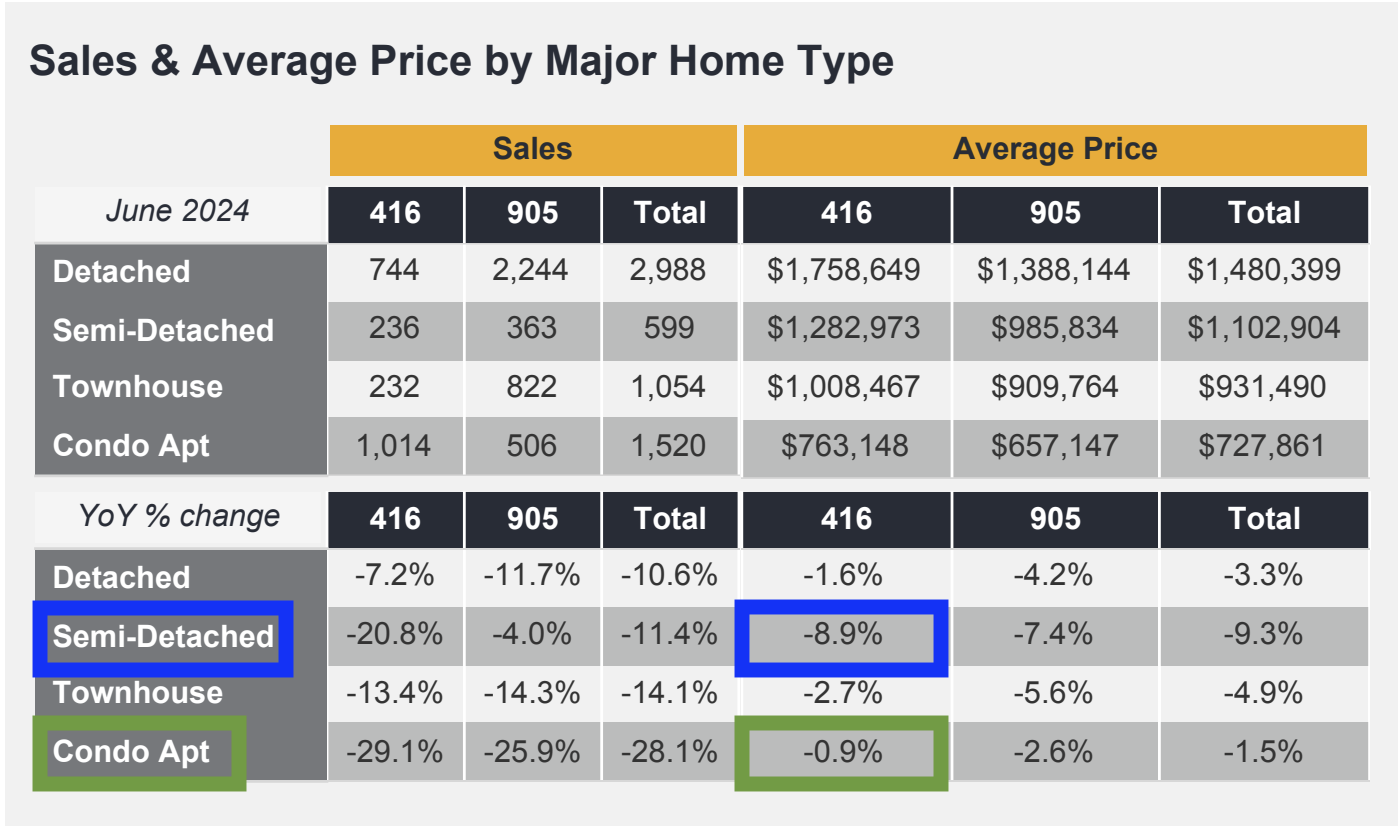

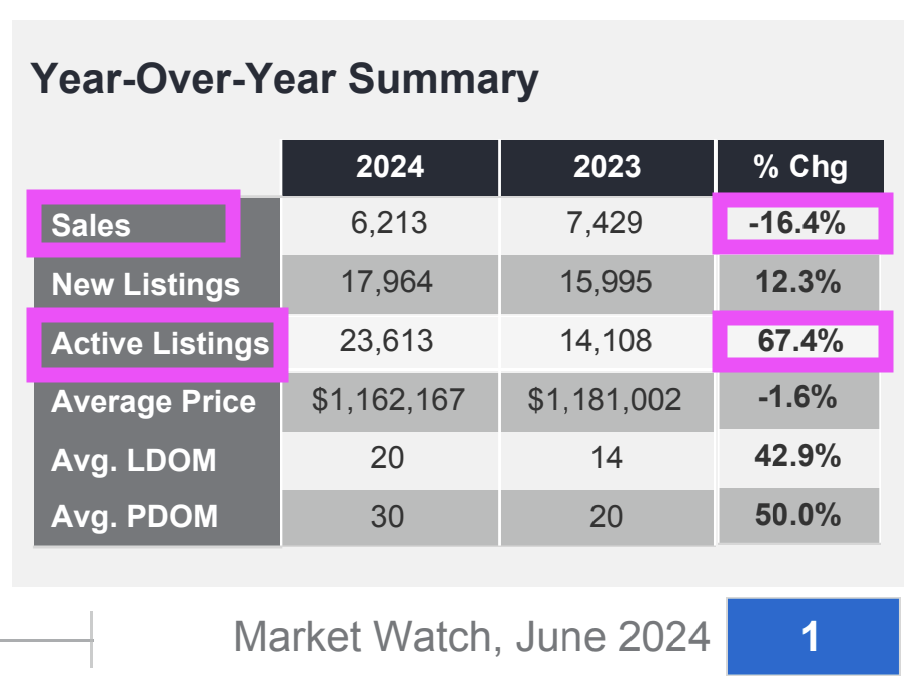

✨ Annual comparison: the average GTA home price in June 2024 was $1,162,167 - this is slightly down by -1.6% compared to last year in June 2023. Similar to May, all housing types in the GTA were negative on annual price comparisons. The housing sector with the biggest price drop was semi-detached homes in Toronto which saw an -8.9% annual decrease, while Toronto condos performed the best with a -0.9% annual price decrease.

✨ Monthly comparison: the average Greater Toronto Area home price in June 2024 also decreased marginally by -0.3% compared to May 2024

✨ While a few housing sectors are outperforming the average market (e.g. condos in Forest Hill South and Humewood-Cedarvale experienced an incredible +13.04% price increase over the past year), the vast majority of freehold and condo markets are still in the negative as a result of ongoing high mortgage interest rates and a significant surge in housing inventory

📊 SALES VOLUMES

✨ Despite a recent rate cut last month by the Bank of Canada on June 5th, the continued sales slump indicates buyers are still cautious and waiting for further rate reductions

✨ June saw -16.4% fewer sales in the GTA compared to last summer

✨ While Toronto condo prices performed the best with a marginal -0.9% annual price decrease, Toronto condos were the housing sector with the lowest sales performance at -29.1% fewer condo sales compared to last year June 2023. On the other hand, semi-detached homes in the 905 suburbs performed the best with a slight -4.0% decrease in sales

🔎 INVENTORY

✨ Despite the dramatic surge in the number of properties available for sale back in May, our inventory rose even further. We were at a significant 21,760 active listings for sale in May 2024 while in June 2024 the number of properties for sale rose to 23,613. Our June 2024 inventory was a substantial +67.4% increase compared to last year in June 2023. To put things into perspective, the last time June had just over 23,000 listings was thirteen years ago in June 2011 (mortgage rates were about 5.39% in June 2011)

✨ June continued to be an extremely challenging month for the vast majority of sellers due to two main driving forces: (1) the surge in the number of properties available for sale since May (2) and the ongoing high mortgage interest rates

🔮 THIS IS THE IDEAL MARKET FOR

✨ We are in an incredible market favouring buyers. For most housing types and most neighbourhoods, buyers have an extensive array of choices where they have the rare upper hand in negotiating

✨ One market statistic often quoted is the "months of inventory", which indicates how many months it would take to sell out the current inventory given the current sales volumes if no new properties were added to the market. This indicator helps us to understand if we're in a balanced market or if our current market is favouring sellers or buyers. Back in our heated seller's market of 2021, we would have an average of 1.5 months of inventory on the market. Fast forward to today's market, condos have 5.8 months of supply (we are absolutely in a buyer's market for condos) and single-family detached homes have 3.4 months of supply (this is a more balanced market and for comparison, last year single-family homes were down to 1.9 months of inventory). For those of us looking for excellent real estate opportunities and are willing to hold a property for at least the next few years, this is a fantastic time to purchase. Many qualified buyers are strangely hesitant in this slower market despite the advantages they can capitalize on. Only a few short years ago in 2021 and the first quarter of 2022, many buyers would be bidding on properties at their budget's upper limit, in fear that they would either be priced out of the market in a few short months or they would drastically be required to dial back on their wishlist to secure a property - it was also a stressful time as a buyer since nearly all transactions at that time required waiving a home inspection condition and waiving a mortgage financing condition. In comparison, today's market is much more relaxed for buyers to shop in: while there's less pressure from multiple offers, the best-priced opportunities this summer are fleeting and may not return

✨ For buyers trying to "time the market", our advice is to focus on the long-term hold. If you find a property this summer that matches nearly all your wishlist items and falls within budget, consider if you believe you will be able to secure that same property at today's prices in 2, 3, or even 4 years from now.

✨ Many industry experts are anticipating a busier market in 2025 when more buyers will be active: with increased demand and higher sales volumes, home prices will be higher than today's prices. Further supporting buyers, while the Bank of Canada's latest rate cut hasn't significantly improved affordability, the key takeaway is that economists and the Bank of Canada predict interest rates will decrease as inflation stabilizes. This offers significant relief for buyers entering today's market, who can choose shorter 2-3 year terms and renew, at most likely, a considerably lower rate

✨ Today's market conditions are paving the way for future gains. Follow advice from successful investors such as Warren Buffett: capitalize on opportunities when others are hesitant

Post a comment