Toronto Real Estate July Market Update - Buyers Benefit from Increased Choice Amidst Stable Prices. Top Toronto real estate agents with the best reviews

Saturday Aug 10th, 2024

Toronto's Summer Market: Buyers Benefit from Increased Choice Amidst Stable Prices

📈 Home Prices

✨ Considering an incredible +55.4% increase in the number of properties for sale in the Greater Toronto Area (GTA), housing prices on average remain quite stable with only modest price declines

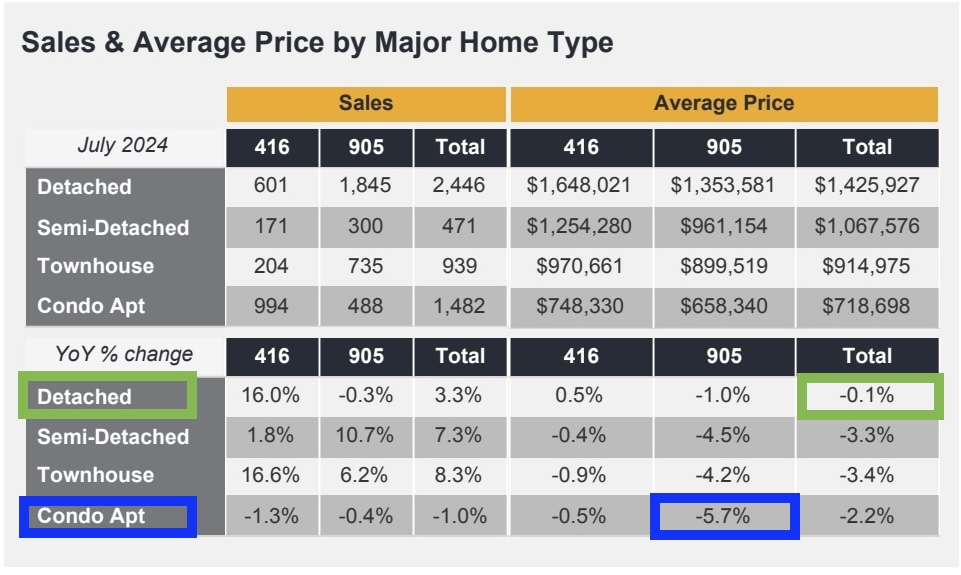

✨ Annual Price Trends: in July 2024, the average GTA home price dipped slightly by -0.9% year-over-year, settling at $1,106,617. This continues the trend seen in May and June, where all housing types recorded modest declines. However, detached homes in Toronto bucked the trend with a slight +0.5% increase. The steepest drop was in suburban condos, which faced a -5.7% price decrease

✨ Monthly Price Trends: the average GTA home price in July saw a modest decrease of -4.78% compared to June

✨ While certain housing sectors such as detached homes in Rosedale and Moore Park have outperformed the market with a +4.24% price increase over the past year, the majority of freehold and condo markets are still experiencing marginal price declines. This trend is largely driven by elevated mortgage interest rates and a strong supply of available properties for sale

📊 Sales Volumes

✨ Annual Sales Trends: The Toronto Regional Real Estate Board (TRREB) reported 5,391 property sales in July, marking a marginal +3.3% increase compared to the same month last year. However, what many media outlets overlook is that pre-COVID, a balanced market in July typically saw around 7,000 home sales. This means current sales are more than -20% lower than what we would expect in a balanced market. Does anyone remember a balanced market though? Many of us tend to compare today’s numbers to the more recent heated seller’s market, like July 2021 when over 11,000 homes were sold. With sales volumes remaining low across most GTA neighbourhoods, we are firmly in a buyer’s market

✨ Monthly Sales Trends: Home sales slowed significantly in July, with a -13.2% drop compared to June

🔎 Inventory Supply

✨ The GTA continues to see elevated levels of new listings, with a +18.5% increase year-over-year, providing buyers with a wide array of choices across different home types. This abundant supply has kept price growth in check, creating an opportunistic environment for buyers to make their purchases

🔮 Interest Rates and Market Outlook

✨ The recent Bank of Canada rate cuts in June and July have already sparked more buyer activity. Right now, buyers enjoy favourable conditions with greater negotiating power. However, as additional mortgage rate decreases take effect, sales are expected to accelerate, leading to tighter market conditions, higher prices, and less inventory to choose from. With another rate cut expected soon in early September, a resurgence in price growth could happen quickly. This summer is a prime opportunity to secure an amazing property before the market shifts away from a buyer's market

✨ For buyers who are active in the market, our team advises buyers not to delay once they've found the right home: in July, just over 17% of properties sold in less than a week. Those who assume they have a lot of time to weigh their decision may find that their dream home is gone before they act

✨ For buyers waiting to "time the bottom of the market," the GTA may already be past that point, or in some areas such as the Toronto condo market, it could be happening now. With steep increases in housing supply over several consecutive months—a trend we haven’t seen in over 12 years—paired with stable home prices, this market presents an outstanding opportunity and the stable prices are a strong indication that the bottom of the market might have passed for a number of market sectors. Buyers who want to secure solid investments will want to act now before future rate drops trigger a surge in buyer activity. Our team has handpicked exceptional properties at unbeatable prices for clients, reminiscent of those last seen in 2018-2019: some of these properties are priced over $300K lower than what the current owner originally paid, making them prime investments for those seeking outstanding value. If you're looking for guidance in selecting the right property, give our team a call.

Post a comment