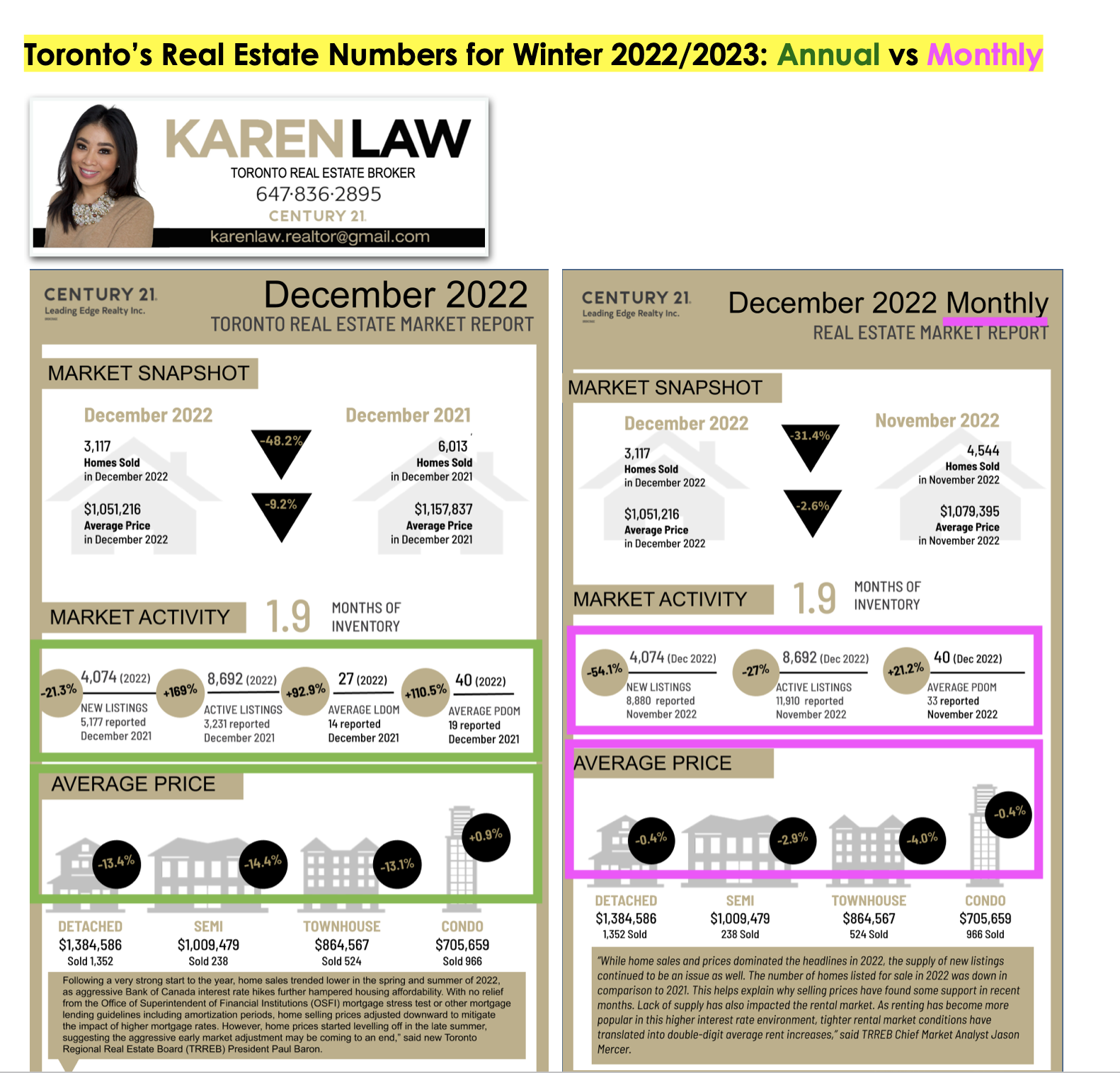

Our latest real estate market report for the Greater Toronto Area (GTA) continues to reflect how increased mortgage interest rates have heavily reduced the number of individuals purchasing and selling real estate, along with reducing housing prices 📉🏡

The Bank of Canada increased mortgage interest rates seven times last year in 2022 which quickly transitioned our heated seller's market into our current buyer's market. It will be interesting to see the Bank of Canada's decision at our next rate announcement later this month on January 25th.

Most of us want to know about housing price trends and real estate market predictions for this year. A few key factors to consider this year, aside from interest rates, are the impacts of the two-year Foreign Buyer Ban on Canadian real estate, the impacts of the new Vacant Home Tax in Toronto, and other government initiatives to help control our country's high inflation rate.

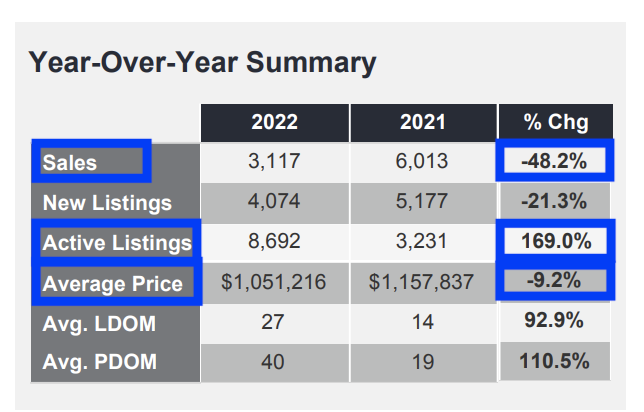

As a result of the higher costs of home ownership, sales volumes are down ⬇️ -48.2% compared to the same time last year: this is essentially half the amount of real estate purchases compared to the same time last year in December 2021. This is a significant drop in sales volumes which has been trending over the past several months.

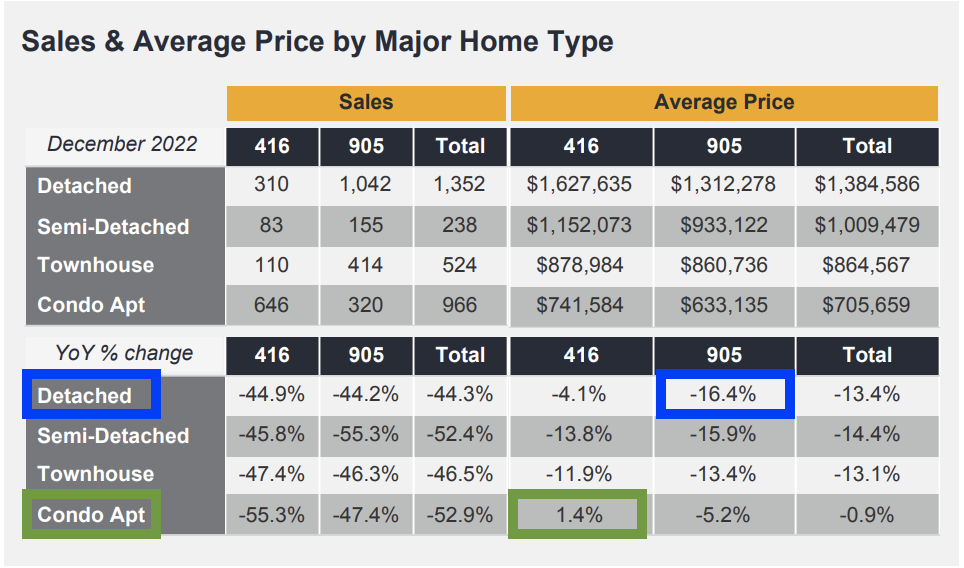

In terms of housing prices, the more expensive housing sectors saw the strongest price decreases over the past year. In particular, detached homes and semi-detached homes in the suburbs were hit the hardest. Detached homes experienced the biggest price drop of -16.4% between December 2021 to December 2022 ⬇️.

On the other hand, the market sector that saw the highest annual price increase on average was Toronto condos which saw a conservative +1.4% increase in prices between December 2021 to December 2022 ⬆️.

The downward price trend seen in the Spring and Summer of 2022 is slowing down with housing prices flatlining throughout the Fall and Winter of 2022. This is good news for individuals with properties listed for sale and those who are planning to sell a property soon.

Tips for Selling

*Instead of marketing the property for sale, consider keeping your property as an investment and renting it out. With the majority of rental properties having seen rental price increases of around +17% over the course of the last year in 2021, this is an opportunistic time for the rental income to help cover the cost of ownership for at least another year or two until our inflation is under control and the overall economy has improved. Once our inflation has normalized and the economy has improved, our real estate market is very likely to shift back in favour of sellers.

Although August and early September are the best times to secure a tenant, especially for properties within walking distance to post-secondary schools or within close walking distance to TTC transit, there is an incredible demand for affordable rentals even during our winter months. Overall, with our winter months being a slower time for rentals, stay competitive on the rent price and focus on securing a quality tenant with thorough background screening.

*If you have decided to sell a property this year and keeping it as an investment property is not an option, you will want to put your best foot forward by marketing your property effectively as buyers have way more choices now. This winter, there are 169% more listings than there was last winter: that's more than 2.5 times the amount of housing inventory for buyers to choose from. Buyers have become very sensitive to price. On the selling side, we are unable to change the location of the property, however, we have influence over two factors

(1) the condition of a property: how well a property showing and how well maintained it is. Work with an established real estate team that can provide advice on preparing your property to show its very best and only investing in upgrades/renovations where you can easily recoup more than your investment from the sale of the property

(2) the price of a property: with a number of government initiatives slated for this year that will impact our real estate market (interest rate announcements, our Foreign Buyer Ban, the new Vacant Home Tax in Toronto etc), pay close attention to properties that have just sold under contract as well as neighbourhood properties that have been sitting on the market a long time, in order to provide insight on the current market trend. Strategically price your property accordingly when launching to the market and adjust your plan according to how the market responds.

Work with a real estate team that provides an effective marketing plan to maximize your property's exposure in order to achieve the highest possible sold price in this shifting market. Give our team a call by clicking here.

Tips for Buying

*it's a good time to purchase property in the GTA for a long-term hold & investment. Industry experts are predicting that housing demand will pick back up in the GTA over the medium to long-term outlook as a result of record-high immigration. For those in a cash position who are able to purchase real estate in the GTA and able to hold onto the property over the mid-to-long term (holding onto the property for at least the next four years), our current buyer's market is a good time to act. There are +169% more active listings in the GTA than there were last December 2021. This means there is more opportunity to negotiate a better price and more favourable terms, especially for properties that are not offering a particularly unique or rare feature

*Are you a condo owner who is looking to move into a larger home within the GTA? If so, now is a great window of opportunity to do so. With the Toronto condo market performing much stronger than suburban detached homes over the past year on price, it is an ideal time for condo residents to move up into a larger home as the price gap between condos and freehold homes is smaller.

If you're looking for guidance in navigating this shifting market & effectively achieving your goals in selling or purchasing real estate, feel free to contact our team by clicking the link below.

________________

#Torontorealestate #Torontorealestateagents #Torontorealestatespecialists #realestateupdate #marketshift #topagents #Torontorealestatemarket #Torontorealestateprices #Torontohousingprices #Torontohouseprice #mortgageinterestrates #foreignbuyerban #foreignbuyerbancanada #torontovacanthometax #vacanthometax

Post a comment