Buyer's Market in Toronto with Listings Up +70.2%. Toronto home prices at the start of 2025

Friday Feb 14th, 2025

🏡 HOME PRICES: SOME UP, SOME DOWN

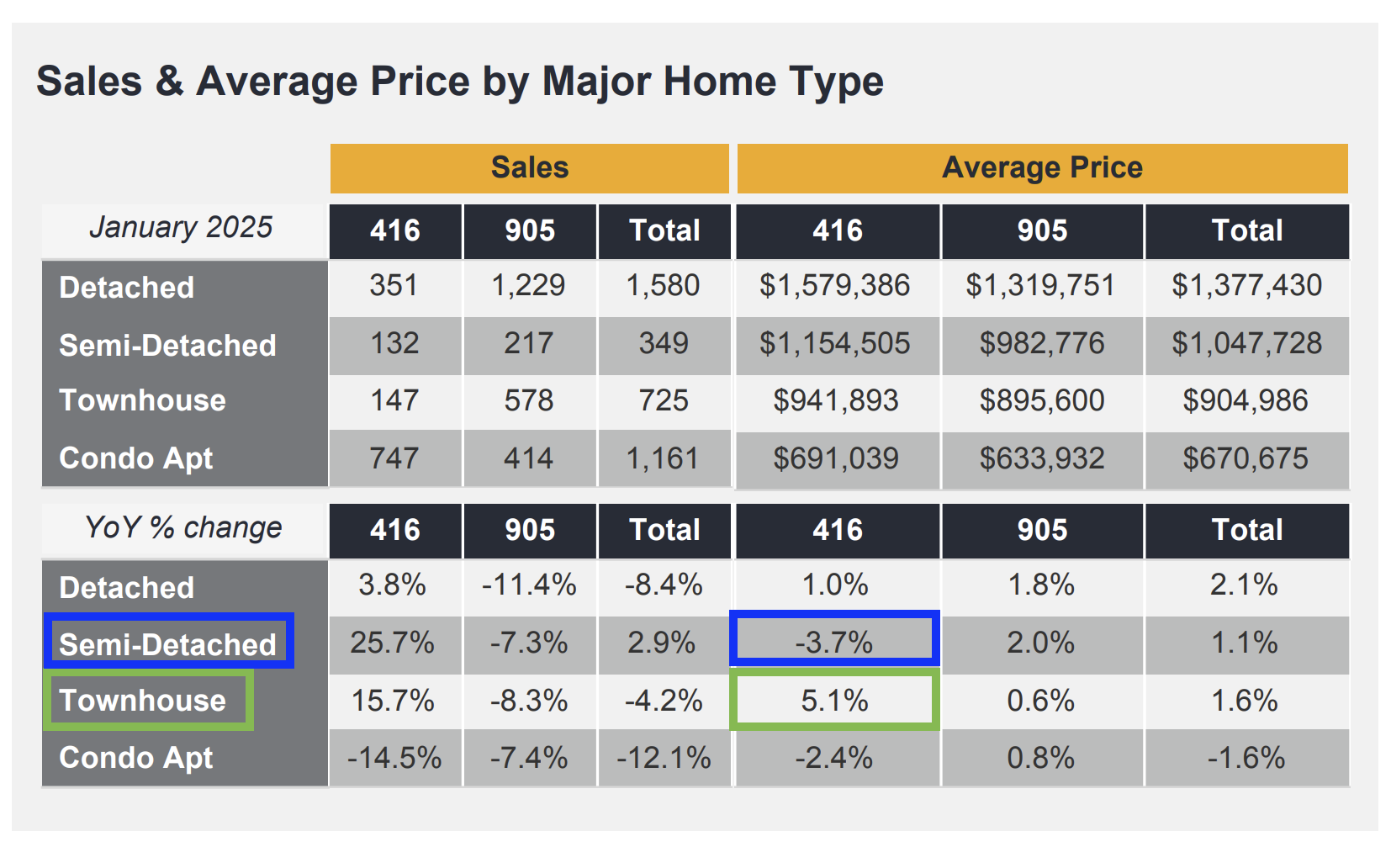

🏡 While the Toronto Regional Real Estate Board (TRREB) reported a modest +1.5% increase in the average home price across the Greater Toronto Area (GTA), the reality is that price trends vary by neighbourhood and property type. For instance, detached homes in High Park North & The Junction have surged by +16.36% from January 2024 to January 2025, while detached homes in Rosedale-Moore Park have declined by -6.35% over the same period.

The overall trend? Many neighbourhoods are gradually shifting out of a buyer’s market as certain areas and property types rebound in price—some even attracting multiple offers. However, with more than half the market still favouring buyers, savvy buyers continue to secure incredible deals across the GTA, particularly in the condo market.

📊 MARKET STILL FLOODED WITH LISTINGS

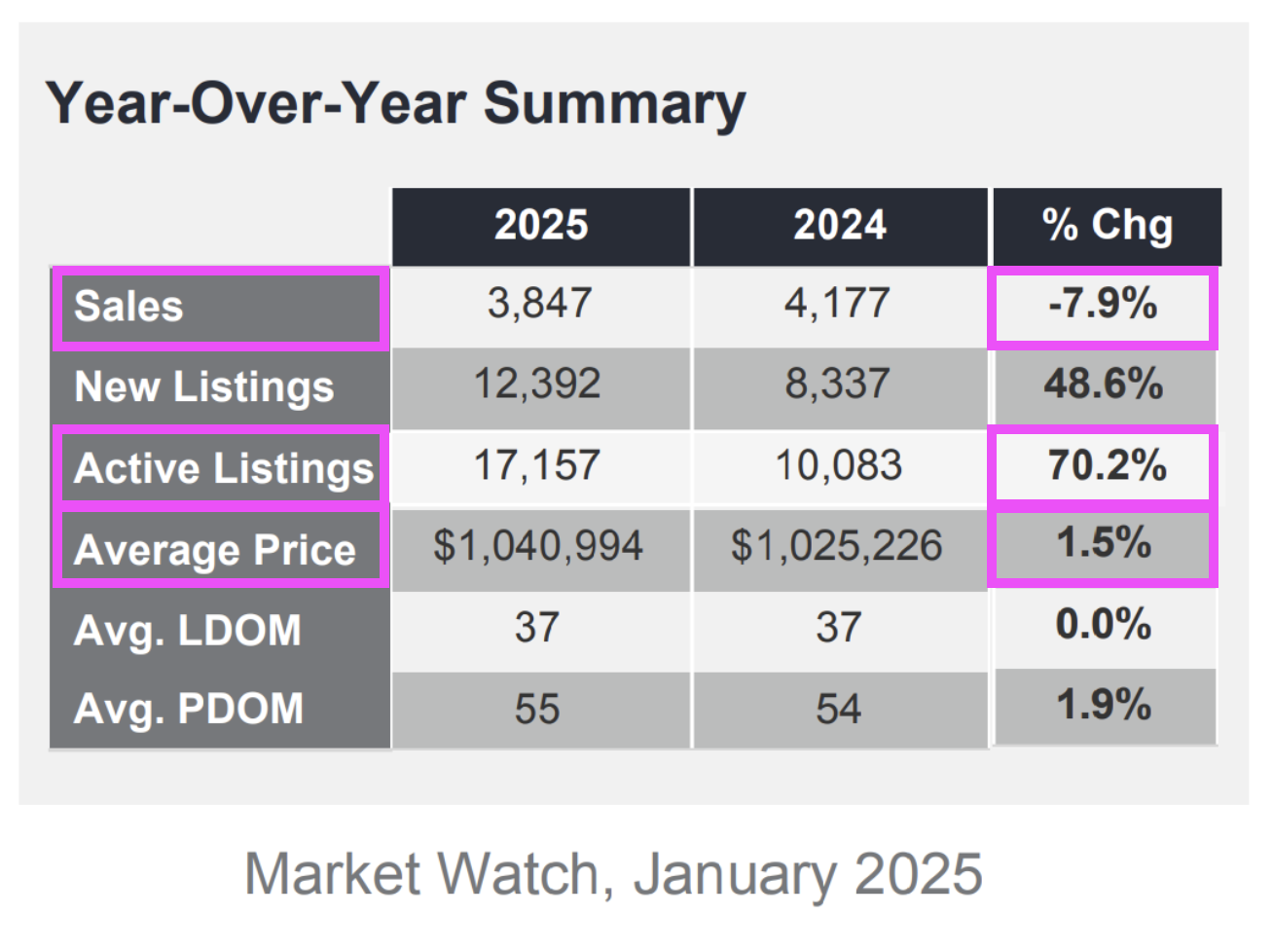

📊 High inventory levels persist across the GTA, with 17,157 active listings—marking a massive +70.2% year-over-year increase! This surge in available properties, combined with historically low sales volumes, is keeping average home prices only slightly higher overall, while numerous neighbourhoods and home types remain negative in year-over-year price comparisons.

For buyers, this abundance of listings means an exceptionally favourable market with more choices and negotiating power.

📉 SALES ARE DOWN -7.9%

📉 2025 is off to a slower start than last year, with just 3,847 sales, reflecting a -7.9% annual decline. Toronto condos led the trend with a -14.5 % drop in sales, followed closely by suburban detached homes, which saw an -11.4% annual decrease.

For buyers, this slowdown presents a prime opportunity. With inventory up +70.2% year-over-year, there are significantly more options to choose from, giving buyers stronger negotiating power. On top of that, mortgage rates are trending downward, with the Bank of Canada cutting rates for the sixth consecutive time on January 29th—improving affordability and making homeownership more accessible.

🔮 MARKET FORECAST

The GTA’s real estate market had been showing signs of recovery, but rising economic uncertainty and U.S.-Canada trade tensions are making buyers hesitant. The start of the new year saw a huge surge in listings, but sales remain sluggish as concerns over job losses and tariff impacts weigh on consumer confidence. In January, active listings soared +70.2% year-over-year, while sales dropped nearly 8%—a clear sign that some buyers are treading cautiously.

At the same time, the Bank of Canada has now issued six consecutive rate cuts, most recently lowering the policy rate to 3% on January 29, 2025. While this has made mortgages more affordable, if trade tensions push Canada closer to a recession, we can expect even faster rate cuts to help stimulate the economy. This environment presents a unique opportunity for buyers—especially for those looking at long-term investments in Toronto real estate. With more homes available and a downward trend in rates, buyers can secure properties with greater negotiating power and lower carrying costs. While the GTA housing market remains sluggish overall, savvy buyers who act now are positioning themselves for significant growth in the years ahead.

Post a comment