Toronto home prices in 2024. Top real estate agents in Toronto on Google

Saturday Jan 11th, 2025

🏡 HOME PRICES DIP

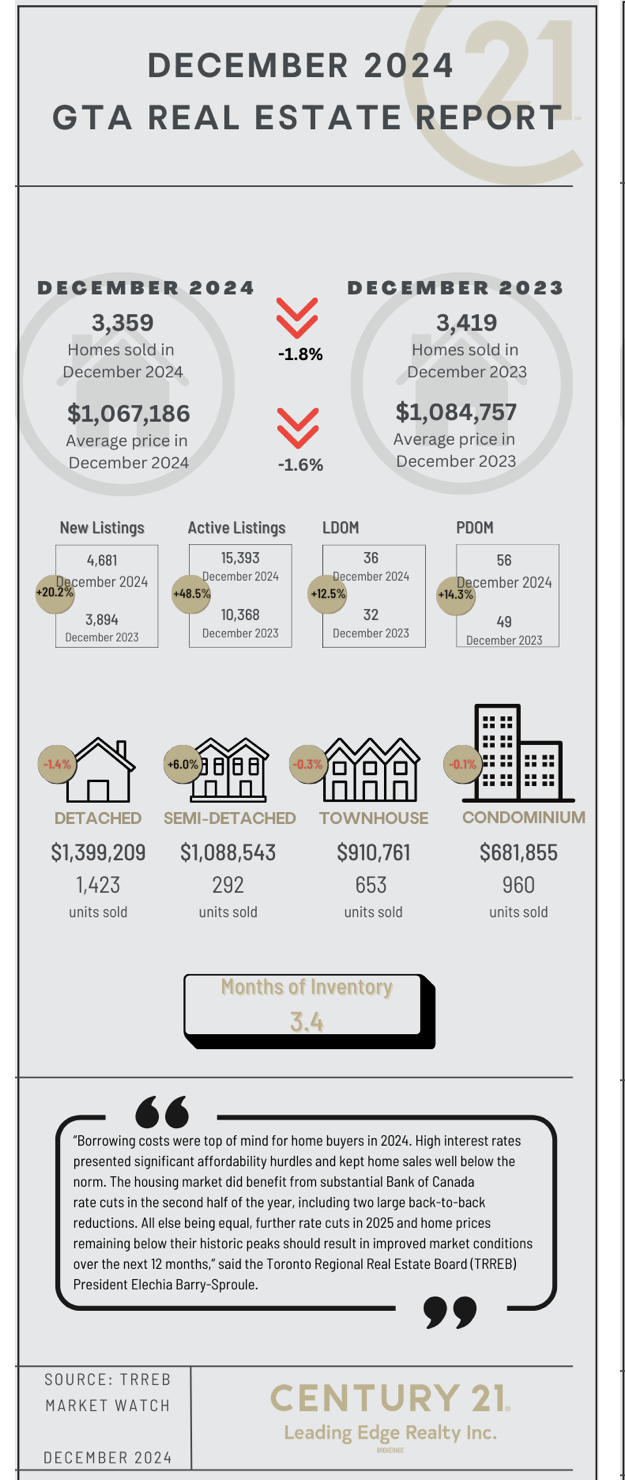

🏡 The average home price in the Greater Toronto Area (GTA) dipped to $1,067,186 in 2024, marking a -1.6% decline compared to 2023. Price declines were also seen month-over-month, with a -3.5% drop from November to December 2024. Buyers, especially in the condo market, are benefiting from substantial negotiating power, although Toronto townhouses faced the sharpest price decline, down -18.2% on average in December. For savvy buyers, the start of winter offered an excellent opportunity to secure amazing deals across the GTA.

📉 HIGH INVENTORY LEVELS REMAIN

📉 High inventory levels persist across the GTA, with 15,393 active listings—marking a substantial 48.5% year-over-year increase. This surge in available properties, paired with historically low sales volumes, has contributed to a decline in average home prices in 2024, creating an exceptionally favourable market for buyers.

🚀 SALES VOLUMES

📊 December 2024 saw just 3,359 sales across the GTA. While this reflects a modest -1.8% decrease compared to December 2023, it marked the lowest sales level this year. The market remains significantly below the typical 5,000-6,000 sales in a balanced market. Many sellers are experiencing substantially longer days on the market before receiving offers, highlighting a notable shift in buyer behaviour. For savvy buyers, this slowdown presents a prime opportunity to purchase in today's market conditions—where strategic moves can make all the difference.

🔮 Market Outlook

With 2024 behind us, we’re stepping into the new year with optimism and opportunity in the real estate market.

Signs of economic stability are already emerging, with inflation settling at 1.9% in November—a level many economists consider ideal. This sets the stage for potential interest rate cuts, with the next Bank of Canada announcement on January 29th. Lower borrowing costs would not only ease affordability but also bolster consumer confidence in the housing market.

Industry experts and media alike are anticipating a busy spring market, fueled by pent-up buyer demand and indicators point to stronger sales volumes and increased property prices later in the first half of the year. For savvy buyers, the current market presents a prime opportunity to make their move before competition intensifies. Meanwhile, sellers who are planning to list their property may benefit from waiting until spring, when anticipated rate cuts by the Bank of Canada are likely to create conditions that favour stronger offers.

Whether you’re planning to buy or sell, navigating these market shifts requires expertise and strategy. Reach out to our team today by calling us at 647-836-2895 —we're here to help you make the most of 2025's real estate opportunities.

Post a comment