Interest Rates in May 2025. Interest Rate Update - What Today's Rates Mean for Your Mortgage Strategy. Best customer rated real estate agents in Toronto

Monday May 12th, 2025

Interest Rate Update – What Today’s Rates Mean for Your Mortgage Strategy

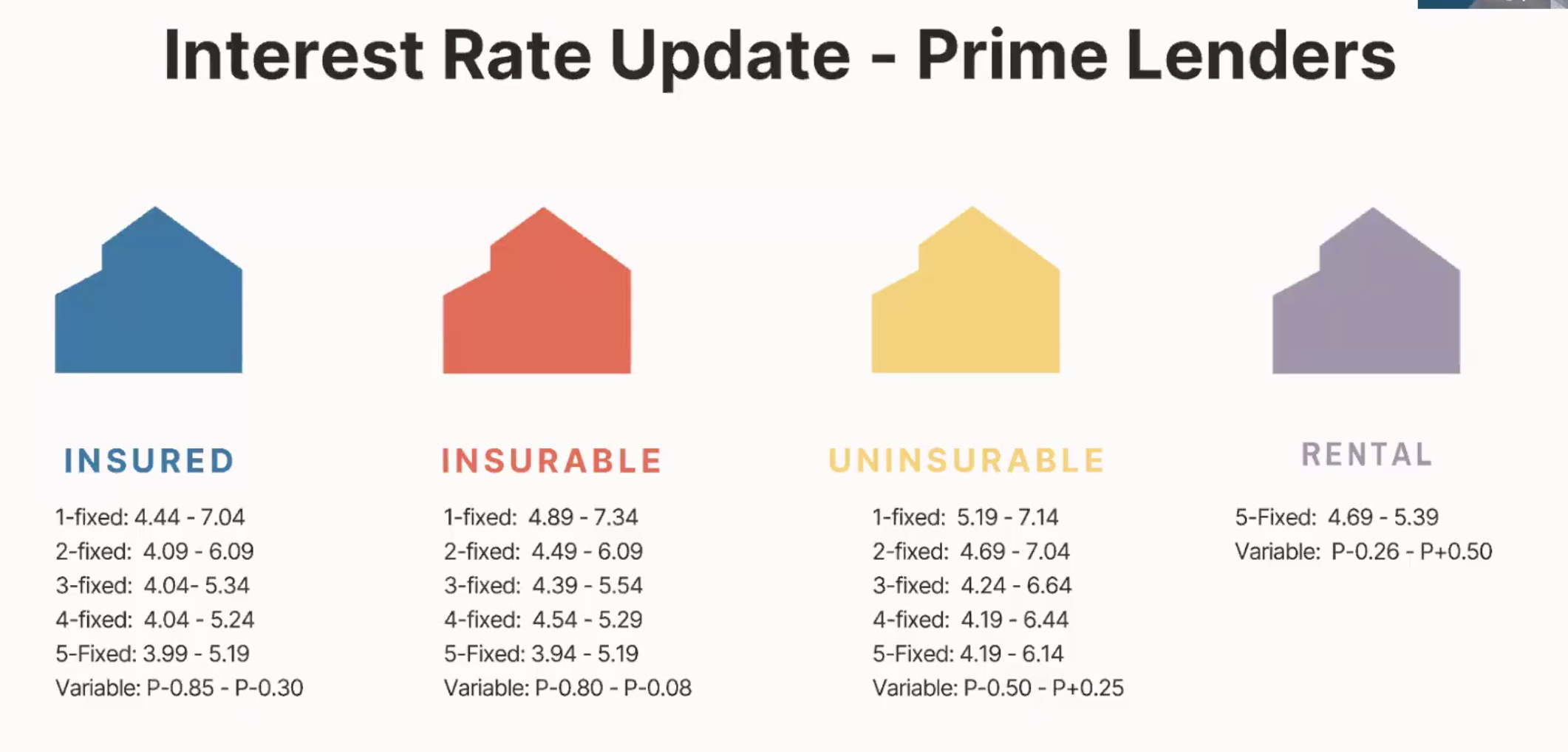

Navigating interest rates can be overwhelming, especially with so many options available depending on your down payment, property value, and intended use. Here’s a quick breakdown of the current prime lender mortgage rates:

Insured Mortgages (for less than 20% down):

These often come with the most competitive rates. For example, 5-year fixed terms are currently offered as low as 3.99%, and variable rates range from Prime - 0.85 to Prime - 0.30.

Note: Most Canadians are choosing variable or 2–3 year fixed terms right now to stay flexible as rate trends evolve.

Insurable Mortgages (20% down or more, principal residence, under $1.5M):

Rates are slightly higher than insured but still attractive—particularly for shorter terms and variables. Variable rates range from Prime - 0.80 to Prime - 0.08.

Uninsurable Mortgages (properties over $1.5M, rental use, or longer amortization):

Expect higher rates, especially on fixed terms. Variable rates range from Prime - 0.50 to Prime + 0.25, reflecting increased lender risk.

Rental Property Rates:

For investment properties, rates are in a different category. 5-year fixed ranges from 4.69% to 5.39%, and variables span Prime - 0.26 to Prime + 0.50.

Whether you're buying your first home, upsizing, or investing, the right mortgage product can save you thousands over time. Not sure which category your property fits into or how to structure your mortgage strategy?

Post a comment