How much does the average home cost in Toronto? Toronto market update February 2023. The 10 best real estate agents in Toronto

Monday Mar 13th, 2023

Are we beginning to see a slight seasonal shift in the market?

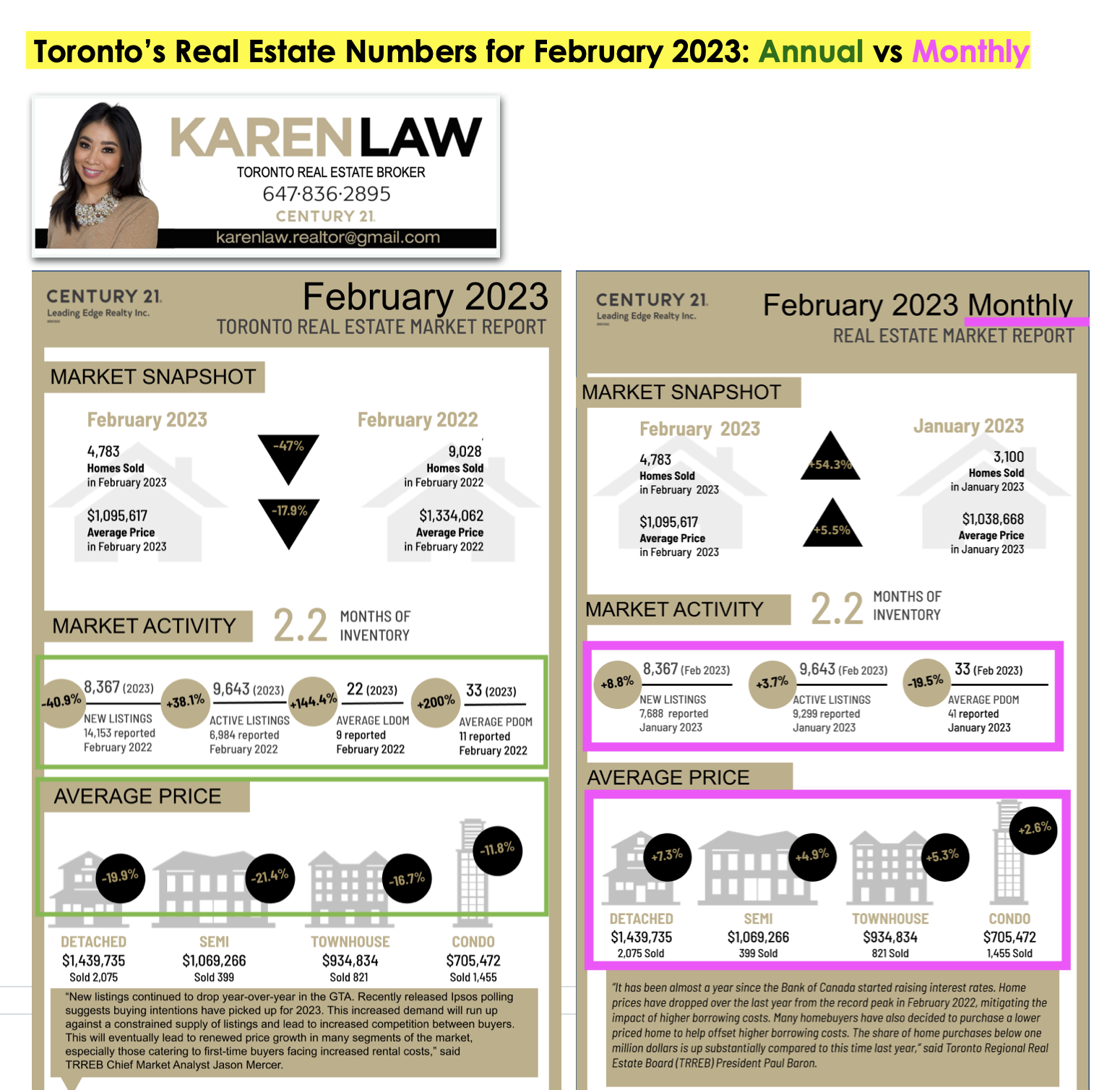

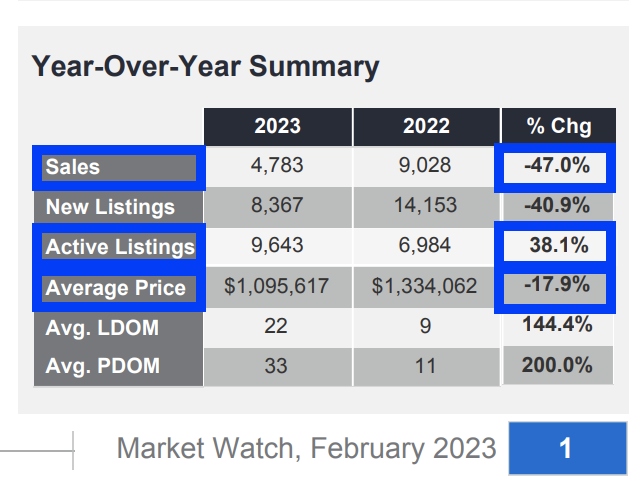

While an annual comparison of the latest housing numbers in the Greater Toronto Area (GTA) indicates an ongoing trend of softened home prices and slower sales volumes throughout the month of February, February did see a +5.5% increase in average home prices compared to the previous month January 2023. Seasonally, it is normal to see a slight uptick in February sales volumes and home prices.

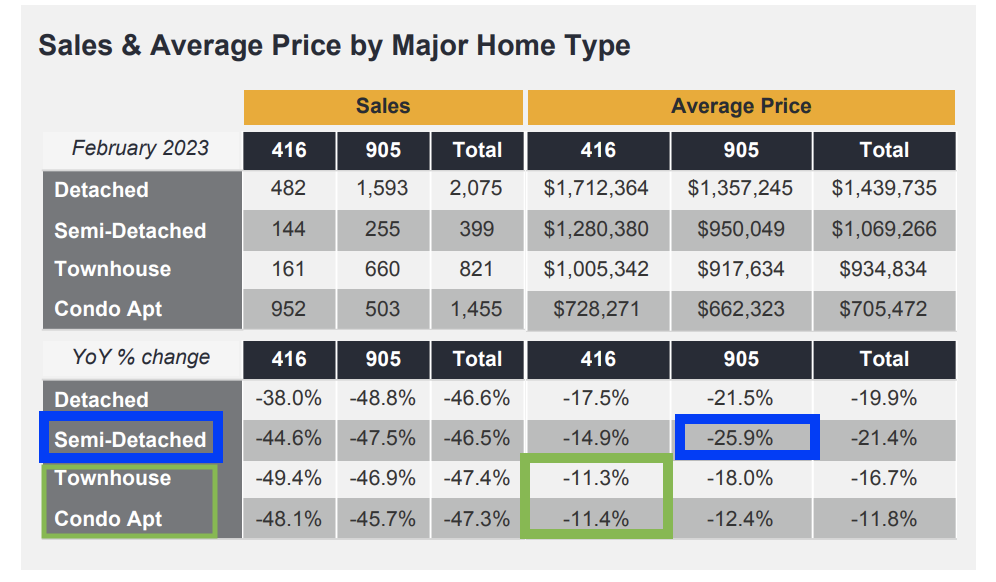

The GTA is still in a buyer's market nonetheless where the trend of seeing the most affordable properties selling is evident: 57% of home sales in February 2023 were under the $1M price tag when in comparison, when the prime rate was 4.25% lower last February, only 38% of home sales were below $1M in February 2022.

Buyers looking to move into the suburbs are favoured with the largest price decrease in suburban semi-detached homes. Over the past year, suburban semi-detached homes lead with the largest average price drop of -25.9% between February 2022 to February 2023. On the other hand, Toronto townhouses and condos are holding on the strongest with their market value, decreasing in price by an average of -11.3% and -11.4% respectively, over the past year.

With the latest Bank of Canada prime rate held steady for the first time in a year, it will be interesting to see how buyer activity shifts as we enter our Spring Market.

Tips for Selling

*on average, properties priced below $1M will receive more buyer showings and are more likely to sell in a timely manner. Some mid range properties and especially higher end luxury properties are likely to experience a considerable length of time on the market and/or are unable to sell. With significantly higher ownership costs due to the current mortgage rates, sales volumes are down -47% compared to early last year and the majority of properties that are selling are below $1M in price. February saw a +19% increase in properties that sold below $1M. Thus, while this market is more favourable for entry level priced homes, if you are selling a mid range or luxury property, assess the feedback from buyer showings within the first 1-2 months on the market. If your property is receiving less than 10 showings a month with no offers, be open to changing your strategy in order to get the property sold. This might require (i) adjusting the price to market demands or (ii) making certain upgrades/repairs in order for prospective buyers to come forward with an offer close to your list price or (iii) taking the property off the market and re-listing it for sale when the market recovers, while renting it out in the interim to help cover the costs of ownership.

*if you have decided to sell a property this year, consider moving up your timeframe to market your property for sale this early Spring before prime rates possibly increase again. With inflation currently around 5.9%, in order to come close to our target rate of 2% later this year, there is a lot of speculation that the Bank of Canada will increase prime rates again this year. Remember that every single rate increase over the past year had negatively impacted the final selling price of properties. There are six more rate announcement dates for the remainder of this year. Consider marketing your property for sale now while the prime rate is being held steady, in favour of selling.

Tips for Buying

*this is an ideal time to move up from a condo into a freehold property, especially if you wish to purchase a house in the suburbs. The price gap between the average condo and the average freehold property is favourable with detached and semi-detached homes having decreased in price substantially more than the average condo. Consult with your bank or mortgage broker as the first step, to help determine your financial standing and your ideal budget. Then with the help of a good real estate team and a third party appraiser, you will understand the market value of your current home and whether it is a financially beneficial for you to make that move into a larger home.

If you're looking for guidance to navigate this market & effectively achieve your goals in selling or purchasing real estate, contact our team at 647-836-2895 ☎️

Post a comment