April 2022 Toronto Real Estate Market Update 🏡 Toronto real estate agents with the most record home sales

Friday Apr 08th, 2022

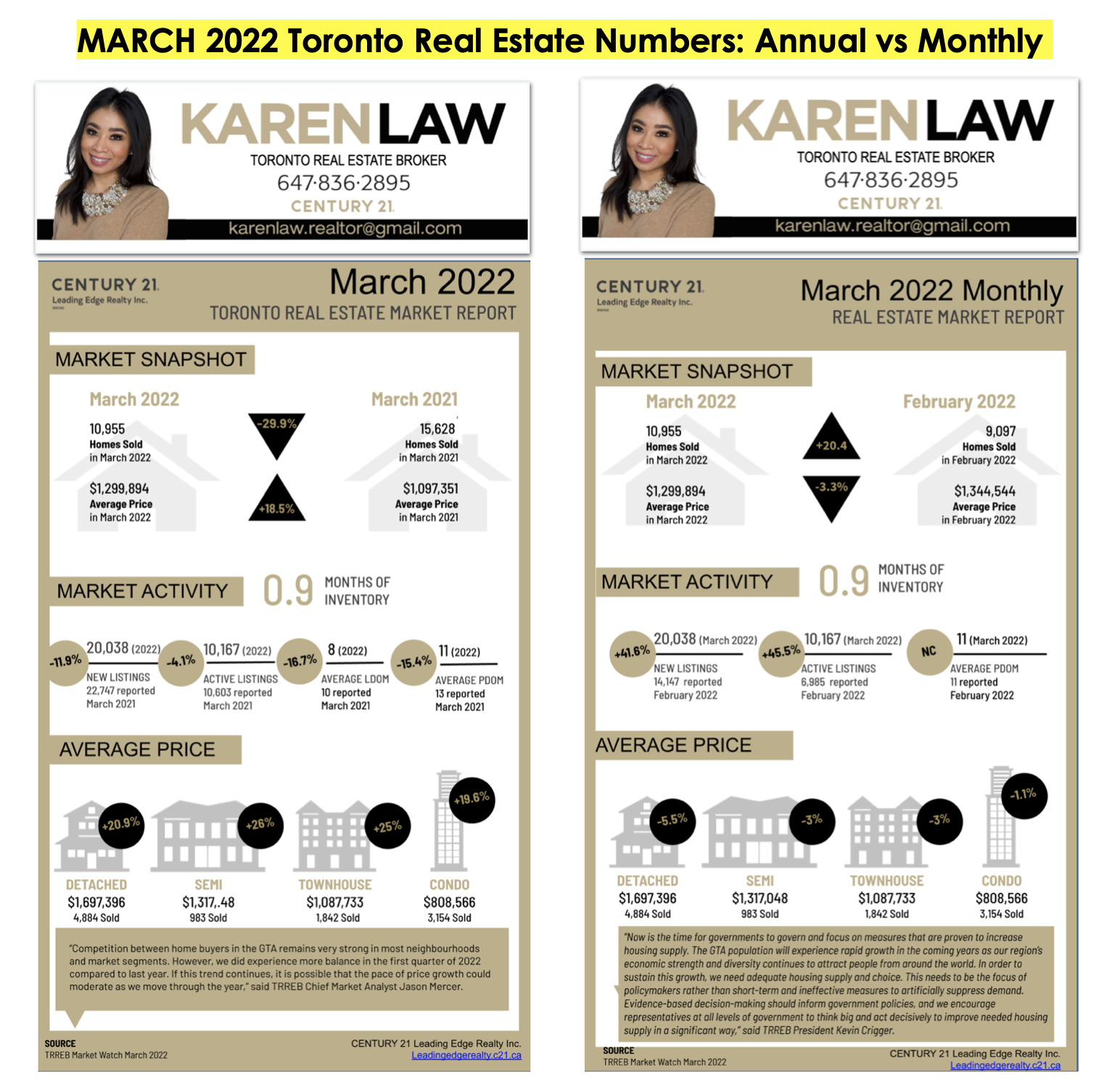

March 2022 saw the beginnings of a shift towards a more balanced market, after having such a strong seller's market in January and February 🏡

Compared to last year March 2021 which was a record-breaking March for the history of TRREB in terms of sales volume, our March 2022 sales volume saw a 30% decline. Despite a 30% decline sounding negative since we are comparing it to a record number, our March 2022 sales were in fact, an exceptional month for sales (it's the third-best March in the history of TRREB) 🏆

Housing prices, on a month-to-month comparison, have come down a bit in all market sectors compared to the previous month of February 2022.

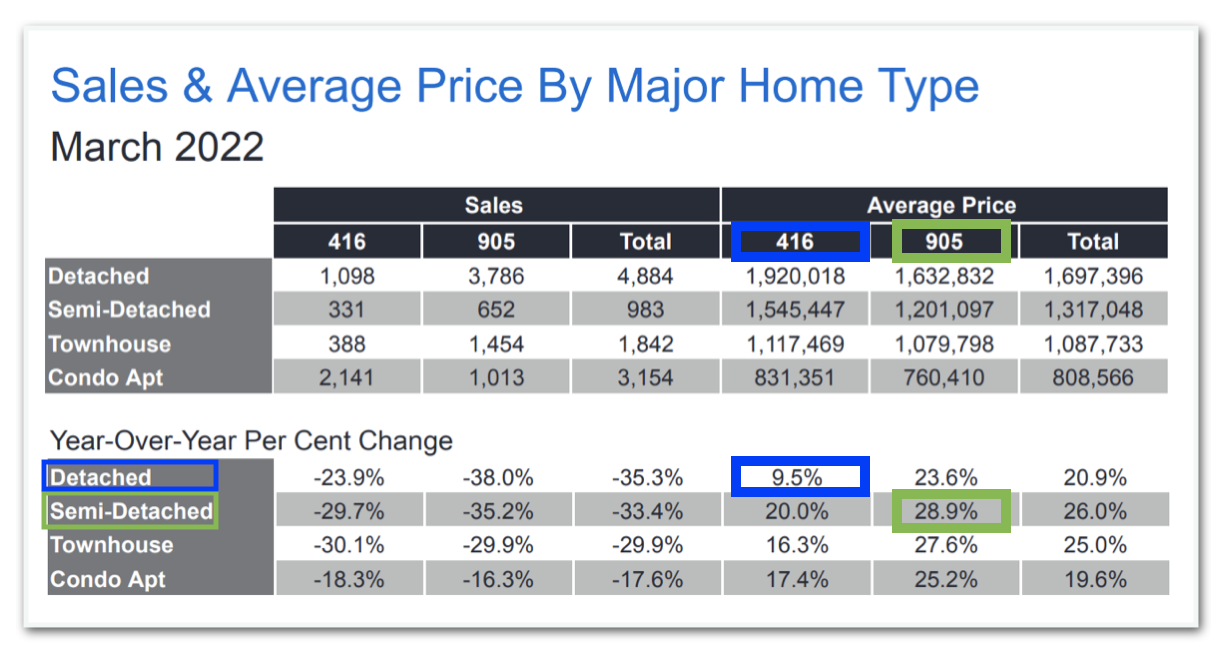

For annual price growth, with the exception of detached homes in Toronto, all housing sectors saw double-digit percentage increases when it came to home prices. The housing sector that saw the highest increase in value, on average, continues to be semi-detached homes in the 905 suburbs with an exceptional +28.9% increase in prices over the past year. On the flip side, the housing sector that saw the lowest increase in value, on average, were detached Toronto homes which still saw a +9.5% increase in prices between March 2021 to March 2022.

The average property price in the Greater Toronto Area is holding steady with a significant increase of +18.5% to $1,299,894 over the past year.

Are we beginning to see a shift away from the heated seller's market?

Yes, there has indeed been a slow down in March compared to the first two months this year. Properties are staying longer on the market, which in turn creates more current inventory for purchasers. Also, we are beginning to see some properties reducing their ambitious list prices. These are factors we did not see earlier this year.

In addition, there have been a number of recent government announcements including a two-year ban on foreign buyers purchasing Canadian real estate, multiple interest rate hikes set for this year to help offset inflation, and a Toronto vacancy tax being implemented this year for the first time. These government policies are set to cool down the market a bit.

Tips for Selling

*do you remember the advice our team shared over a month ago encouraging homeowners who are planning to sell a property this first half-year, to consider marketing their property as soon as possible? That advice still holds true, especially with our prime minister's official announcement on April 7th, 2022 that there will be a two-year ban on foreign buyers purchasing real estate in Canada. Although the details have not been released just yet (e.g. the implementation date, exemptions etc), we can expect to see a softening of the heated seller's market. Don't think this will have an impact? Check out the TRREB stats between April 2017 to August 2017 when the non-resident speculation tax was first introduced in April 2017, by clicking here. Back in April 2017 housing prices were seeing 25%-32% annual appreciation rates and by July 2017, detached homes were down negative -1.2% in prices as a result of the government legislature. We will certainly see a softening of the market for a period of time, as a result of our latest government announcements. If your goal is to achieve the highest price possible and obtain an ideal closing date, you will want to work with a real estate team offering a strategic and effective marketing plan to help you achieve this especially since the market has already started to shift away from a heated seller's market.

Consider working with a team that provides an effective marketing strategy to maximize your property's exposure in order to achieve a higher sold price.

Tips for Buying

*there is more inventory on the market right now and we are seeing a bit of relief for buyers navigating a heated seller's market. If you are on the market to purchase a home, the first step is to get preapproved if you plan to finance your real estate purchase. From there, working with a trusted real estate team to keep a close eye on market activity week-to-week will help you navigate this market and purchase the ideal property at the right time. There are a couple of factors to watch as a purchaser: first, interest rates are set to increase multiple times this year (not in favour of purchasers) emphasizing the importance of securing an interest rate with your lender and ideally securing a purchase before that lower rate expires. Second, the latest government policy with foreign buyers banned from purchasing Canadian real estate for two years in combination with a Toronto vacancy tax will likely soften real estate prices for a window of time, creating new opportunities for purchasers to get into the market. These are some key points to consider if you are contemplating a property purchase.

Consider working with a team that can guide you in this shifting market and a team that has access to off-market exclusive listings including VIP broker pre-construction pricing, to provide you with more options!

______________

#infographics #infographic #realestateinfographics #torontomarketupdate #marketupdate #housingmarket #realestatenews #realestateexperts #realestateexpert #marketreport #homevalue #homevalues #realestatenumbers #torontorealestatebroker #torontorealestateagent #torontorealestate #onlinelearning #learnsomethingnew #c21 #century21 #century21agent #realestateadvisor #propertyexpert #propertyexperts #realestatelearning #learnonline #onlineteaching #marketstats #marketstatistics #realestatenumbers #housingstats

Post a comment